Throughout human history, gold has stood as a beacon of financial stability amid economic storms. While currencies have collapsed, stock markets have crashed, and empires have fallen, gold has maintained its purchasing power across millennia. This remarkable ability to preserve value makes gold a cornerstone asset for those seeking long-term financial security in an increasingly uncertain world. As we navigate today’s complex economic landscape, understanding why gold preserves value becomes essential for anyone looking to protect their wealth against inflation, currency devaluation, and market volatility.

The Historical Perspective: Gold’s Enduring Value

Gold’s role as a store of value dates back to ancient civilizations. The Egyptians considered gold the flesh of the gods, while the Romans established gold as the foundation of their monetary system. Throughout history, gold has been the ultimate form of money, transcending cultural and geographical boundaries.

Unlike paper currencies that can be printed at will, gold’s supply increases by only about 1.5% annually through mining. This natural scarcity has ensured that gold preserves value regardless of economic conditions. A Roman centurion paid in gold could purchase roughly the same amount of goods as someone using the equivalent gold value today – a testament to gold’s remarkable stability.

During the 20th century alone, the U.S. dollar lost over 96% of its purchasing power, while gold’s value increased more than 50-fold in dollar terms. This stark contrast highlights why many investors turn to gold as a long-term store of value rather than relying solely on fiat currencies.

Economic Principles Behind Gold’s Value Preservation

Scarcity: The Foundation of Value

Gold’s ability to preserve value stems primarily from its scarcity. All the gold ever mined throughout human history would fit in a cube measuring just 21 meters on each side. Unlike fiat currencies that can be created through printing presses or digital entries, gold’s supply is constrained by geological limitations and the significant resources required for mining.

This inherent scarcity means that gold cannot be “inflated away” like paper money. When governments increase money supply to address economic challenges, each existing currency unit typically loses purchasing power. Gold, with its relatively fixed supply, tends to maintain or increase in value during such periods.

Intrinsic Properties: Beyond Monetary Value

Gold possesses unique physical properties that contribute to its enduring value. It doesn’t corrode, rust, or tarnish. It’s malleable enough to be shaped into intricate forms yet dense enough to store substantial value in a compact space. These characteristics have made gold valuable for jewelry, technology, and monetary applications throughout history.

Unlike many commodities that are consumed, most of the gold ever mined still exists in some form today. This permanence reinforces gold’s role as a store of value that can be passed down through generations.

Discover How to Protect Your Wealth with Gold

Learn the insider strategies for preserving your wealth through precious metals. Our free guide reveals how gold can safeguard your retirement from inflation, market crashes, and currency devaluation.

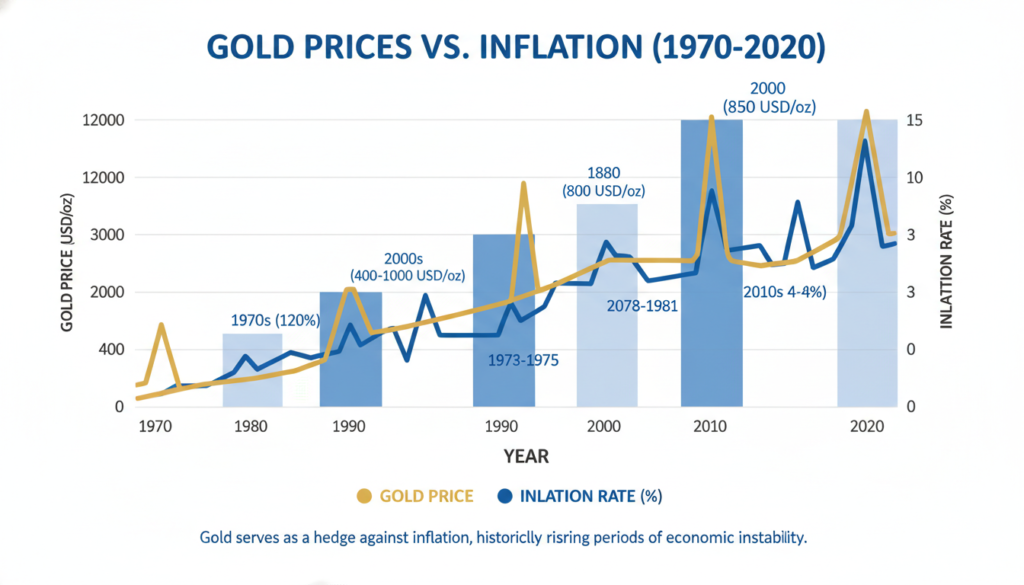

Gold vs. Inflation: The Ultimate Hedge

Inflation erodes purchasing power over time, making each dollar worth less as prices rise. Gold has historically served as an effective hedge against this silent wealth destroyer. During the high inflation period of the 1970s, gold prices soared from $35 per ounce to over $800, delivering returns that far outpaced inflation rates.

This pattern has repeated throughout modern economic history. When inflation rises, central banks typically respond by raising interest rates, which can negatively impact stocks and bonds. Gold, however, often thrives in these environments as investors seek tangible assets that preserve value.

Even during periods of low reported inflation, gold has maintained its purchasing power while many currencies have gradually declined. This makes gold particularly valuable for retirement planning, where preserving wealth over decades becomes crucial.

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now.” – Warren Buffett

Gold During Market Volatility and Economic Crises

Market crashes and economic crises often trigger a flight to safety among investors. During the 2008 financial crisis, while the S&P 500 fell by over 50% from its peak, gold increased by approximately 25%. This negative correlation with traditional asset classes makes gold valuable for portfolio diversification.

Similar patterns emerged during other major market downturns. The COVID-19 pandemic in 2020 saw gold reach all-time highs as economic uncertainty peaked. This consistent behavior during crises demonstrates gold’s reliability as a safe haven asset.

Central Bank Demand: A Vote of Confidence

Central banks worldwide have been net buyers of gold since 2010, adding thousands of tons to their reserves. This institutional demand reflects gold’s status as a trusted store of value even among the world’s most sophisticated financial entities. Countries like Russia, China, and India have significantly increased their gold holdings to reduce dependence on the U.S. dollar and protect against currency risks.

This trend of central bank accumulation provides a strong foundation for gold’s continued role in preserving value. When the institutions responsible for managing national wealth choose gold as a reserve asset, it signals confidence in its long-term stability.

Gold vs. Currencies: The De-dollarization Trend

The global financial system has relied on the U.S. dollar as its primary reserve currency since the Bretton Woods agreement. However, a gradual shift toward de-dollarization has been underway, with many countries seeking alternatives to reduce their exposure to a single currency’s risks.

Gold has emerged as a key beneficiary of this trend. Unlike national currencies that can be devalued through monetary policy decisions, gold remains outside the control of any single government. This independence makes it an attractive option for preserving value in an increasingly multipolar world.

The BRICS nations (Brazil, Russia, India, China, and South Africa) have been particularly active in accumulating gold reserves while reducing their dollar holdings. This shift reflects growing recognition of gold’s role as a neutral store of value that transcends geopolitical tensions.

Gold’s Role in a Modern Investment Portfolio

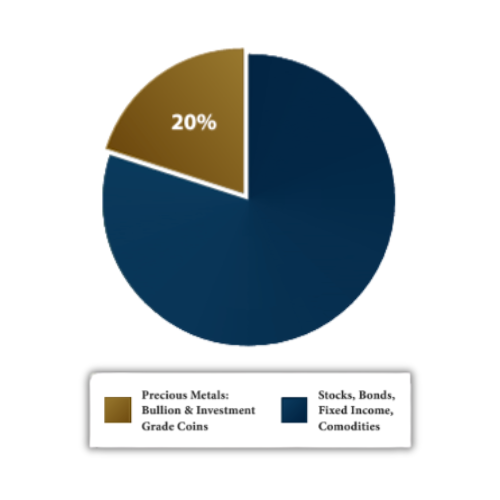

Financial advisors often recommend allocating 5-10% of an investment portfolio to gold as a diversification strategy. This allocation helps balance the risk associated with more volatile assets like stocks while providing a hedge against inflation and currency devaluation.

Gold’s low correlation with traditional asset classes makes it particularly valuable during market downturns. When stocks and bonds fall simultaneously (as they sometimes do during crises), gold often moves independently or even in the opposite direction, helping to stabilize overall portfolio performance.

Gold IRAs: Tax-Advantaged Value Preservation

For retirement planning, a Gold IRA offers a tax-advantaged way to hold physical precious metals. These specialized individual retirement accounts allow investors to own actual gold bullion or coins rather than paper assets like stocks of mining companies.

The primary advantage of a Gold IRA is combining gold’s value preservation properties with the tax benefits of a traditional or Roth IRA. This structure can be particularly beneficial for those concerned about preserving purchasing power throughout retirement.

Physical Gold vs. Paper Gold: Understanding the Difference

Investors can gain exposure to gold through both physical ownership and paper assets. Physical gold includes bullion, coins, and bars that you can hold in your hand. Paper gold refers to financial instruments like ETFs, mining stocks, and futures contracts that track gold’s price without providing actual ownership of the metal.

While both approaches offer exposure to gold’s price movements, they differ significantly in terms of counterparty risk. Physical gold in your possession has no counterparty risk – its value doesn’t depend on another entity’s promise or financial health. Paper gold, however, introduces various levels of counterparty risk depending on the specific instrument.

The Future Outlook: Gold in an Uncertain World

As we look toward the future, several factors suggest gold will continue to preserve value effectively. Growing global debt levels, ongoing currency debasement through quantitative easing, and increasing geopolitical tensions all create an environment where gold’s traditional strengths become more relevant.

Central banks worldwide continue to accumulate gold at a record pace, suggesting that even in our increasingly digital world, physical gold remains the ultimate form of financial insurance. This institutional confidence provides a strong foundation for gold’s continued role as a store of value.

Secure Your Financial Future with Gold

Ready to learn how gold can protect your retirement savings from inflation, market volatility, and currency devaluation? Augusta Precious Metals offers a comprehensive free guide that reveals proven strategies for preserving wealth with precious metals.

Or visit our website to download your free guide instantly:

Best Precious Metals Companies of 2026

A quick side-by-side snapshot of minimums, fees, and what makes each provider stand out—so you can choose faster and request a free kit.

Augusta Precious Metals

GoldenCrest Metals

Noble Gold Investments

Birch Gold Group

Lear Capital

Conclusion: Gold’s Timeless Value Preservation

Gold’s ability to preserve value over time remains one of its most compelling attributes in an uncertain world. While no asset is without risk, gold’s 5,000-year track record of maintaining purchasing power through wars, depressions, hyperinflations, and regime changes stands unmatched.

For those concerned about protecting wealth against the corrosive effects of inflation, currency devaluation, and market volatility, gold offers a time-tested solution. Whether held as physical bullion, through a Gold IRA, or as part of a diversified investment strategy, gold continues to serve its historical role as a reliable store of value.

As we navigate increasingly complex financial markets and unprecedented monetary experiments, gold’s simplicity and permanence provide a welcome anchor of stability. In a world where the value of most assets depends on promises and projections, gold’s intrinsic worth and limited supply offer something increasingly rare – genuine financial security that transcends time.