When financial markets tumble and economic uncertainty looms, investors often turn to gold as a potential safe haven. But does this precious metal truly live up to its reputation during market crashes? Historical data reveals a compelling pattern: while stocks plummet, gold frequently maintains or even increases its value, serving as a financial anchor during turbulent times. This article examines gold’s performance during market downturns, why it behaves differently than other assets, and how it might fit into your investment strategy during periods of market volatility.

Worried About a Market Crash?

Get the facts on how physical gold and silver may help protect retirement savings during volatility, inflation, and financial uncertainty.

Gold often serves as a safe haven when stock markets experience significant downturns

Gold as a Traditional Safe Haven Asset

For centuries, gold has maintained its status as a store of value across civilizations and economic systems. Unlike paper currencies that can be printed at will by governments, gold’s supply is naturally limited, giving it intrinsic value that transcends political and economic boundaries. This physical scarcity is a key reason why gold is often viewed as “real money” when fiat currencies face pressure.

During times of market stress, investors frequently seek assets that can preserve wealth rather than generate returns. Gold fits this profile perfectly – it doesn’t depend on corporate earnings, doesn’t carry default risk, and historically maintains purchasing power over long periods. This makes gold particularly attractive when traditional investments like stocks and bonds face significant headwinds.

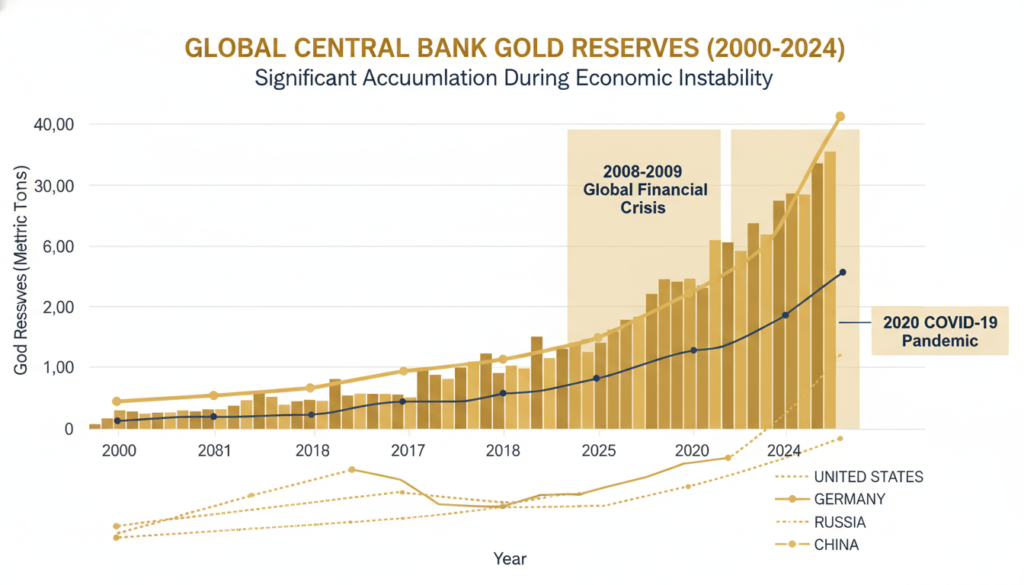

Central banks around the world recognize gold’s unique properties, which is why they collectively hold over 35,000 metric tons of the metal in their reserves. This institutional backing provides additional support for gold’s role as a safe haven during turbulent economic periods.

Historical Performance of Gold During Market Crashes

To understand gold’s behavior during market downturns, we need to examine historical data from previous crashes. The evidence reveals some consistent patterns worth noting.

Gold’s performance compared to the S&P 500 during major market crashes

The 1987 Black Monday Crash

During the infamous Black Monday crash of October 19, 1987, when the Dow Jones Industrial Average plummeted 22.6% in a single day, gold initially rose 3.2% as investors sought immediate safety. This demonstrated gold’s ability to provide immediate protection during sudden market shocks.

The 2000-2002 Dot-Com Bubble Burst

When the technology bubble burst between 2000 and 2002, the S&P 500 lost approximately 49% of its value. During this same period, gold prices rose from around $270 to $350 per ounce, representing a gain of nearly 30%. This extended crash showed gold’s ability to maintain an inverse relationship with stocks over a prolonged downturn.

The 2008 Global Financial Crisis

The 2008 financial crisis provides a more nuanced picture of gold’s behavior. When Lehman Brothers collapsed in September 2008, gold initially gained 10% that week. However, as the crisis deepened and a liquidity crunch forced investors to sell assets to raise cash, gold temporarily declined by about 20% over the following month.

Importantly, gold quickly recovered and began a bull market that saw prices rise from around $700 in late 2008 to over $1,900 by 2011 – a gain of more than 170%. This pattern demonstrates that while gold may experience short-term volatility during a crash, it often recovers faster and outperforms in the aftermath.

The 2020 COVID-19 Market Crash

During the COVID-19 market crash in March 2020, markets experienced extreme volatility. Gold initially fell alongside stocks as investors scrambled for cash, but it quickly stabilized and then surged to all-time highs above $2,000 per ounce by August 2020. This again illustrated gold’s resilience and its ability to thrive in the aftermath of market turmoil.

Want a Crash-Resilient Retirement Strategy?

Learn how many Americans use physical gold inside a self-directed IRA to diversify away from paper-only exposure.

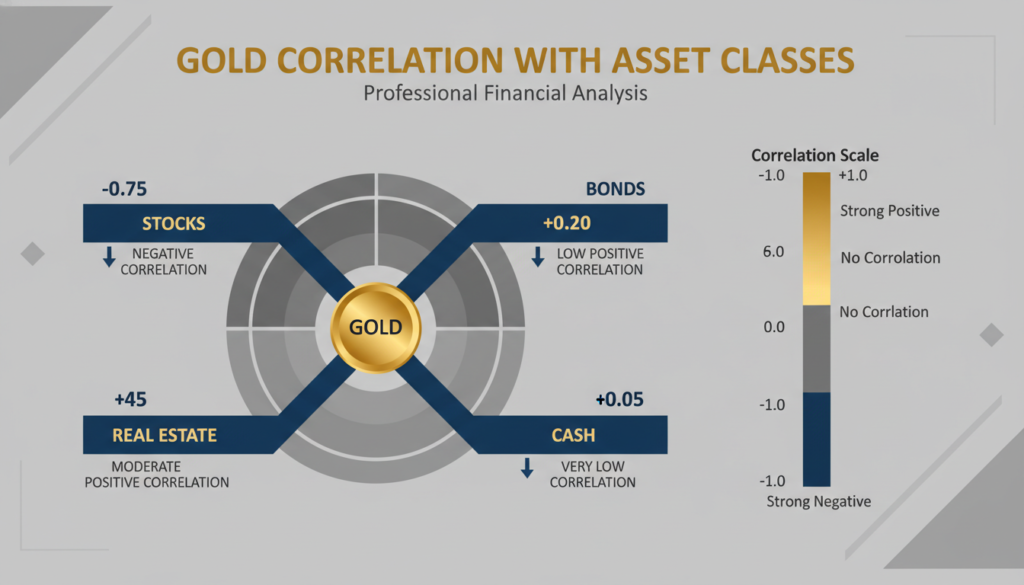

Understanding Gold’s Correlation Patterns

Gold’s relationship with other assets is key to understanding its behavior during market crashes. Data shows that gold typically has a low or negative correlation with stocks, meaning it often moves in the opposite direction of equity markets.

Gold’s correlation with major asset classes shows its diversification benefits

Over the past 50 years, gold has shown a correlation coefficient of approximately -0.2 with the S&P 500 during periods of market stress. This negative correlation becomes even stronger during severe market downturns, often dropping to -0.4 or lower. This statistical relationship confirms what history shows: when stocks suffer their worst declines, gold frequently moves in the opposite direction.

However, it’s important to note that this relationship isn’t perfect. During extreme liquidity crises, gold can temporarily move with stocks as investors sell anything of value to raise cash. This explains gold’s initial decline during parts of the 2008 and 2020 crashes before its subsequent recovery and outperformance.

Gold’s correlation with bonds is also worth examining. During normal market conditions, gold and high-quality bonds often show a slight positive correlation as both can benefit from declining interest rates. However, during periods of high inflation or financial system stress, gold may outperform bonds significantly, as it did during the stagflationary 1970s.

Why Gold Often Rises During Market Crashes

Several economic and psychological factors explain why gold frequently performs well during market crashes:

Investors often turn to physical gold during periods of economic uncertainty

Flight to Safety

When market crashes occur, investors experience a psychological “flight to safety” – moving capital from perceived risky assets to those considered more secure. Gold’s 5,000-year history as a store of value makes it a natural destination during these periods of heightened risk aversion.

Central Bank Policies

Market crashes typically trigger expansionary monetary policies from central banks, including interest rate cuts and quantitative easing. These policies often devalue currencies and raise inflation concerns, both of which benefit gold. Lower interest rates also reduce the opportunity cost of holding non-yielding assets like gold.

Currency Concerns

Major market crashes frequently coincide with concerns about currency stability. As governments implement stimulus measures and increase debt levels, investors worry about currency debasement. Gold, priced in dollars but valued globally, serves as a hedge against declining currency values.

Supply Constraints

Unlike fiat currencies that can be created through monetary policy, gold’s supply grows at only about 1.5% annually through mining. This supply constraint becomes particularly valuable during crashes when governments rapidly expand money supply, potentially leading to inflation.

Limitations of Gold During Market Crashes

While gold often performs well during market crashes, investors should understand its limitations:

Gold can experience significant short-term volatility during market crashes

Short-Term Volatility

As seen in 2008 and 2020, gold can experience significant short-term volatility during the initial phases of a market crash. Investors needing immediate liquidity may be disappointed if they expect gold to immediately rise when markets fall.

No Income Generation

Unlike stocks (dividends) or bonds (interest), physical gold doesn’t generate income. This opportunity cost becomes more significant during long periods of economic stability and growth when other assets may outperform.

Storage and Insurance Costs

Physical gold ownership comes with storage and insurance costs that can erode returns over time. These costs must be factored into the overall investment equation when considering gold as a safe haven.

Potential for Market Manipulation

The gold market, while large, is smaller than major currency and equity markets, making it potentially susceptible to short-term manipulation or extreme volatility during periods of market stress.

Gold Investment Options During Market Uncertainty

Investors looking to add gold exposure as protection against market crashes have several options:

Investors can access gold through physical ownership, ETFs, mining stocks, or specialized accounts

Physical Gold

Owning physical gold coins or bars provides direct ownership without counterparty risk. During severe market crashes involving financial system stress, physical gold offers maximum protection but comes with storage and insurance considerations.

Gold ETFs

Gold-backed exchange-traded funds (ETFs) offer convenient exposure to gold prices without physical storage concerns. These instruments track the price of gold and are easily traded, though they do involve counterparty risk through the financial system.

Gold Mining Stocks

Shares in gold mining companies can provide leveraged exposure to gold prices, potentially outperforming physical gold during bull markets. However, they come with company-specific risks and may not provide the same safe-haven benefits during financial system stress.

Gold Futures and Options

Derivatives offer leveraged exposure to gold prices and can be used for hedging, but require sophisticated knowledge and involve significant risks. These instruments are generally more suitable for professional traders than long-term investors.

Gold IRAs

Specialized Individual Retirement Accounts allow investors to hold certain precious metals within a tax-advantaged retirement account. These accounts combine potential tax benefits with the security of physical gold ownership.

Allocated Gold Accounts

These accounts provide ownership of specific gold bars held by a custodian, combining the security of physical ownership with professional storage. They offer a middle ground between direct physical ownership and paper gold investments.

Best Precious Metals Companies of 2026

A quick side-by-side snapshot of minimums, fees, and what makes each provider stand out—so you can choose faster and request a free kit.

Augusta Precious Metals

GoldenCrest Metals

Noble Gold Investments

Birch Gold Group

Lear Capital

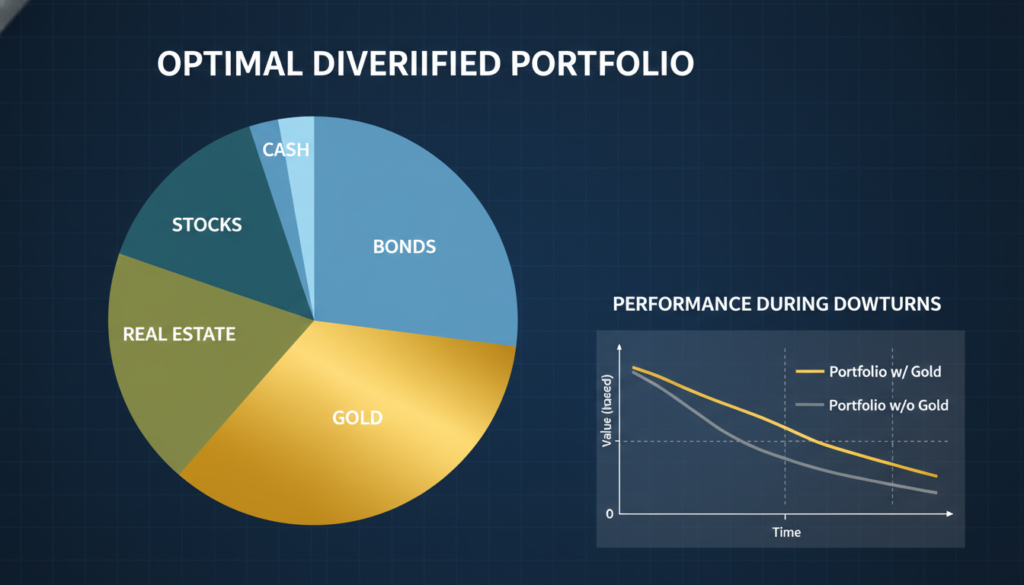

Gold Allocation Strategies for Market Crash Protection

When incorporating gold as protection against market crashes, investors should consider strategic allocation approaches:

Strategic gold allocation can enhance portfolio resilience during market downturns

Percentage-Based Allocation

Many financial advisors recommend allocating between 5-15% of a portfolio to gold as insurance against market crashes. This provides meaningful protection without overexposure to a non-yielding asset. The specific percentage depends on an investor’s risk tolerance, time horizon, and concerns about economic stability.

Dynamic Allocation

Some investors adjust their gold allocation based on market conditions and economic indicators. They might increase gold exposure when valuations appear stretched, inflation risks rise, or geopolitical tensions escalate – all factors that historically precede market crashes.

Dollar-Cost Averaging

Rather than making a single large gold purchase, investors can build positions gradually through regular purchases. This strategy reduces the impact of gold’s short-term volatility and allows for accumulation at various price points.

Barbell Strategy

This approach combines very safe assets (like gold and short-term Treasuries) with higher-risk investments, while minimizing exposure to middle-risk assets. During market crashes, the safe portion (including gold) helps offset losses in the higher-risk portion.

How Central Banks Influence Gold During Market Crashes

Central banks play a crucial role in gold’s behavior during market crashes through several mechanisms:

Central banks have been net buyers of gold since the 2008 financial crisis

First, central banks themselves are major gold holders, collectively owning about one-fifth of all gold ever mined. Their buying and selling decisions can significantly impact gold prices. Since the 2008 financial crisis, central banks have been net buyers of gold, adding support to prices during market downturns.

Second, monetary policy responses to market crashes typically involve interest rate cuts and quantitative easing. These actions reduce the opportunity cost of holding gold (which pays no interest) and raise concerns about currency devaluation and future inflation – all supportive factors for gold prices.

Third, central bank credibility often comes into question during severe market crashes. When investors lose confidence in monetary authorities’ ability to manage economic crises, gold benefits as an alternative monetary asset outside the control of any single institution.

The relationship between gold and central banks during market crashes highlights gold’s dual nature as both a commodity and a monetary asset with deep historical significance in the global financial system.

Conclusion: Gold’s Role During Market Crashes

Historical evidence demonstrates that gold typically performs well during and after market crashes, though with some important nuances. While it may experience short-term volatility, gold has consistently served as a store of value during periods of market stress, often recovering quickly and outperforming conventional assets in the aftermath of crashes.

A strategic gold allocation can help investors navigate market volatility with greater confidence

Gold’s negative correlation with stocks, its global recognition as a store of value, and its historical resilience make it a valuable component of a diversified portfolio – particularly for investors concerned about market crashes and economic instability. The metal’s performance during previous crashes suggests it can provide meaningful protection when traditional investments falter.

However, investors should approach gold with realistic expectations, understanding both its strengths and limitations. Gold works best as one component of a thoughtfully constructed portfolio rather than as a standalone investment. By incorporating gold strategically, investors can enhance their portfolio’s resilience against market crashes while maintaining exposure to growth assets for long-term wealth building.

For those seeking to protect their wealth against market volatility and economic uncertainty, understanding gold’s historical performance during crashes provides valuable context for making informed investment decisions.

Protect Your Savings from Market Crashes

Learn how precious metals like gold can safeguard your retirement portfolio during economic uncertainty. Get expert insights on diversification strategies, tax advantages, and how to properly allocate precious metals in your investment mix.