Investing in a Gold IRA can provide valuable portfolio diversification and protection against inflation, but understanding the associated fees is crucial for maximizing your investment returns. Unlike traditional IRAs, gold IRAs involve physical precious metals that require special handling, storage, and administration—all of which come with specific costs. This comprehensive guide breaks down all the fees and expenses you can expect when opening and maintaining a gold IRA, helping you make an informed decision about whether this investment vehicle aligns with your retirement goals.

Want a Real-World Breakdown of Gold IRA Fees?

Fee schedules can vary by custodian, storage option, and dealer pricing. Augusta Precious Metals provides a free guide that walks through how Gold IRAs work, what costs typically apply, and what to ask so you avoid unpleasant surprises.

Or speak with a specialist:

What Is a Gold IRA?

A Gold IRA (or precious metals IRA) is a self-directed individual retirement account that allows you to hold physical gold, silver, platinum, or palladium instead of traditional paper assets like stocks and bonds. These specialized IRAs offer the same tax advantages as conventional retirement accounts while providing the potential benefits of precious metals ownership.

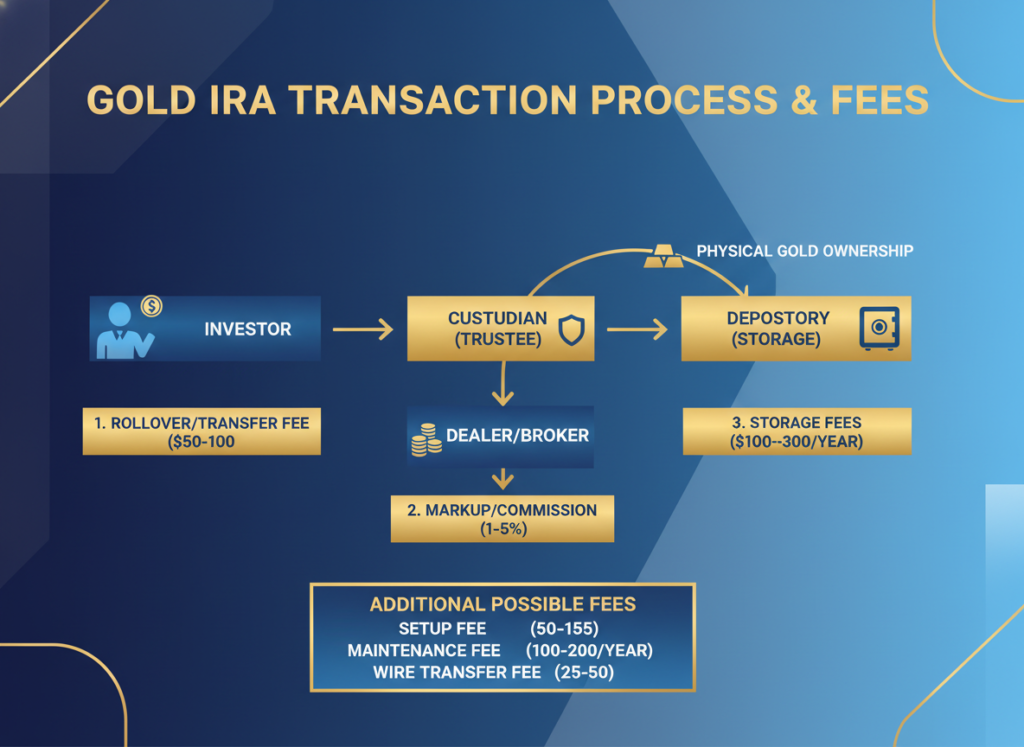

Unlike standard IRAs, gold IRAs require a specialized custodian who can facilitate the purchase, storage, and management of physical precious metals according to IRS regulations. This additional layer of administration and the physical nature of the assets contribute to the unique fee structure of gold IRAs.

Setup and Initial Fees

When establishing a gold IRA, you’ll encounter several one-time fees to get your account up and running. These initial costs typically include:

Account Setup Fee

This one-time charge covers the administrative work required to establish your self-directed IRA. Based on our research of leading gold IRA companies, setup fees typically range from $50 to $150, though some providers may waive this fee for larger initial investments (often $50,000 or more).

Account Transfer or Rollover Fees

If you’re transferring funds from an existing retirement account, your current custodian might charge a transfer fee. These fees generally range from $25 to $75, though many gold IRA companies will reimburse you for these charges to encourage transfers.

Initial Transaction Fees

When purchasing precious metals for your new gold IRA, you may encounter transaction fees for processing your initial purchase. These can range from $40 to $100 per transaction, depending on the custodian and the size of your purchase.

Important: While setup fees are relatively straightforward, they can vary significantly between providers. Some companies advertise “no setup fees” but compensate by charging higher fees elsewhere. Always review the complete fee schedule before choosing a gold IRA provider.

Get a Checklist of What Fees to Ask About

The fastest way to compare providers is to request a written fee schedule and ask the same questions across companies. Augusta’s free kit includes the key topics to review so you can compare apples-to-apples.

Or call:

Annual Custodian and Administration Fees

Custodian fees represent the ongoing cost of maintaining your gold IRA account. These annual charges cover record-keeping, statements, IRS reporting, and general account administration.

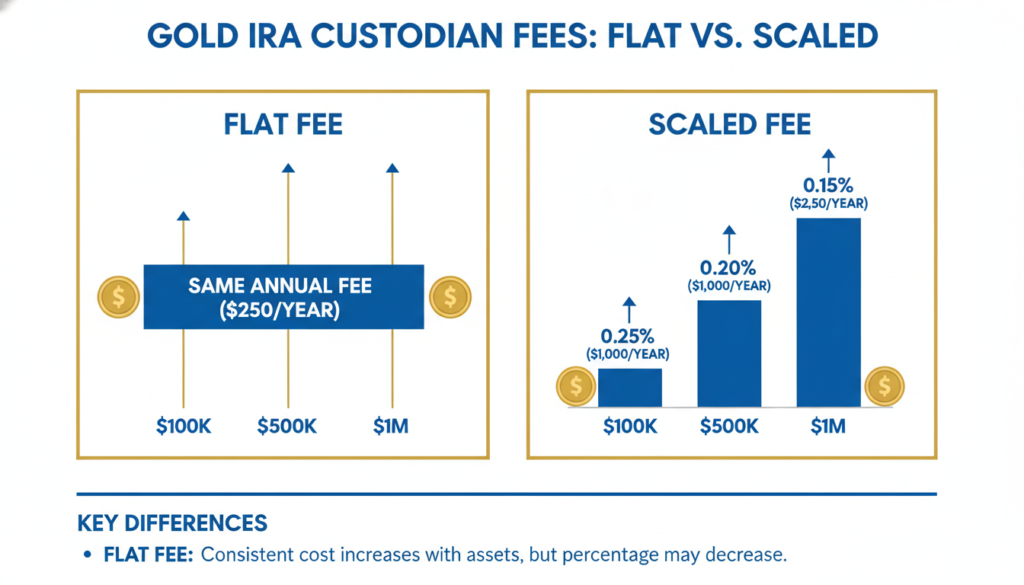

Flat vs. Scaled Fee Structures

Gold IRA custodians typically use one of two fee structures:

Flat Fee Structure

A set annual amount regardless of account size, typically between $75 and $300 per year. This structure is often more cost-effective for larger accounts.

Example: A $125 annual fee on a $100,000 account represents just 0.125% of your assets annually.

Scaled Fee Structure

Fees based on a percentage of assets under management, usually between 0.5% and 1% annually. This structure may be more economical for smaller accounts but becomes more expensive as your account grows.

Example: A 0.75% fee on a $100,000 account would cost $750 annually.

Most established gold IRA companies charge flat annual fees, which can save significant money as your investment grows. Some companies may offer tiered flat fees based on account value brackets.

Storage Fees for Physical Gold

IRS regulations require that physical precious metals in a gold IRA be stored in an approved depository—you cannot keep them at home. These secure storage facilities charge annual fees for their services.

Segregated vs. Non-Segregated Storage

Segregated Storage

Your precious metals are stored separately from other investors’ holdings, with your specific coins and bars kept in a designated space. This option typically costs between $100 and $200 annually, with some providers charging up to $250.

Benefits: You receive the exact same metals you purchased when taking distributions, and there’s additional accountability in the storage process.

Non-Segregated Storage

Your metals are stored together with those of other investors (though still tracked separately in accounting). This option is more economical, usually costing between $75 and $150 annually.

Benefits: Lower cost while still maintaining security and proper accounting of your specific holdings.

Insurance Costs

Most depositories include insurance coverage in their storage fees, protecting your precious metals against theft, damage, or loss. Always verify that your metals are fully insured and understand whether the insurance costs are built into the storage fee or charged separately.

“When evaluating storage options, consider both cost and peace of mind. While segregated storage costs more, some investors prefer knowing their exact coins and bars are kept separate from others.”

Storage + Custodian Fees Add Up—Get the Full Picture

The best providers will explain annual fees, storage options, and how your costs scale over time. Augusta’s free guide breaks down what to expect and what to verify in writing.

Or call:

Transaction and Purchase Fees

Beyond the initial setup, you’ll encounter fees whenever you buy, sell, or exchange precious metals within your gold IRA.

Buy/Sell Transaction Fees

These fees cover the administrative costs of processing transactions within your account. They typically range from $25 to $100 per transaction, depending on the custodian and the complexity of the transaction.

Dealer Markup

While not technically a fee, dealer markup represents the difference between the spot price of gold and the retail price you pay. This markup typically ranges from 2% to 5% for common gold coins and bars, though it can be higher for rare or limited-edition products.

Some gold IRA companies are more transparent about their markups than others. Companies that prominently display both the spot price and their selling price tend to offer more competitive pricing.

Shipping and Insurance Fees

When precious metals are purchased for your gold IRA, they must be transported to the depository. This process involves shipping and insurance costs to protect the metals during transit.

Shipping Costs

Shipping fees typically range from $25 to $50 per shipment, though many gold IRA companies include free shipping for purchases above a certain threshold (often $5,000 or $10,000).

Transit Insurance

Insurance during shipping is essential and typically costs between 0.5% and 1% of the shipment’s value. Most reputable gold IRA companies include this insurance in their shipping fees or absorb the cost entirely for larger purchases.

Tip: When comparing gold IRA providers, ask whether shipping and insurance costs are included in their quoted prices or charged separately. This can significantly impact your overall costs, especially for smaller purchases.

Selling and Liquidation Fees

Eventually, you’ll need to take distributions from your gold IRA, either by selling the metals for cash or by taking physical possession of them. Both options involve specific fees.

Cash Distribution Fees

When selling precious metals from your IRA for cash distributions, you may encounter:

- Seller’s fee: Typically $25 to $50 per transaction

- Wire transfer fee: Usually $25 to $30 if you want funds wired to your bank

- Check fee: Generally $10 to $15 if you prefer payment by check

Physical Distribution Fees

If you choose to take physical possession of your metals (which becomes a taxable distribution), you’ll likely pay:

- Processing fee: Typically $25 to $75

- Shipping and insurance: Usually $25 to $100, depending on the value and weight

- Handling fee: May add another $10 to $25

Account Termination Fee

If you completely liquidate your gold IRA, most custodians charge a termination fee ranging from $50 to $150.

Miscellaneous and Hidden Fees

Beyond the main fee categories, gold IRAs may involve several additional charges that aren’t always prominently disclosed. Being aware of these potential costs can help you avoid surprises.

Common Additional Fees

- Paper Statement Fee: $10 to $30 annually if you opt for paper rather than electronic statements

- Wire Transfer Fee: $25 to $35 per wire transfer

- Late Payment Fee: Typically $25 to $50 if you’re late paying annual fees

- Minimum Balance Fee: Some custodians charge if your account falls below a certain threshold

- Inactivity Fee: May apply if no transactions occur within a specified period

Warning: Always request a complete fee schedule from any gold IRA provider you’re considering. Some companies may not voluntarily disclose all potential fees unless specifically asked.

Avoid Hidden Costs: Use a Provider Comparison Checklist

If you’re interviewing companies, ask for the full written fee schedule and clarify markups, storage, and transaction policies. Augusta’s free guide helps you understand what matters most before you commit funds.

Or call:

Gold IRA Fees vs. Traditional IRA Fees

Understanding how gold IRA fees compare to those of traditional IRAs can help you evaluate whether the additional costs are justified for your situation.

| Fee Type | Traditional IRA | Gold IRA |

| Setup Fee | $0-$50 | $50-$150 |

| Annual Administration | $0-$75 or 0.25%-1% of assets | $75-$300 flat fee |

| Storage | None (digital assets) | $75-$250 annually |

| Transaction Fees | $0-$25 per trade | $25-$100 per transaction |

| Insurance | SIPC coverage (up to $500,000) | Private insurance (included in storage fee) |

| Account Termination | $0-$75 | $50-$150 |

While gold IRAs typically have higher absolute fees, they may represent a smaller percentage of your assets as your account grows, especially with flat-fee structures. The additional costs should be weighed against the potential benefits of holding physical precious metals in your retirement portfolio.

Tips to Minimize Gold IRA Fees

While fees are an unavoidable aspect of gold IRAs, there are several strategies you can employ to reduce their impact on your investment returns:

- Choose flat fees over scaled fees – If you plan to invest more than $25,000, flat fee structures typically become more economical than percentage-based fees.

- Consolidate accounts – If you have multiple small precious metals IRAs, consider consolidating them to reduce the number of annual fees you’re paying.

- Make fewer, larger purchases – Since transaction fees are often charged per purchase rather than based on size, making fewer, larger purchases can reduce your overall transaction costs.

- Consider non-segregated storage – Unless you have specific reasons for wanting segregated storage, non-segregated options can save $50-$100 annually.

- Look for fee waivers – Many gold IRA companies waive certain fees for larger accounts (typically $50,000+) or for the first year.

- Opt for electronic statements – Choosing electronic over paper statements can save $10-$30 annually.

- Compare total costs, not just individual fees – Some providers may have higher fees in one category but lower fees in others. Calculate your expected total annual cost based on your specific situation.

Get Expert Guidance on Gold IRA Fees

Understanding how fees apply to your specific situation can be challenging. For a detailed breakdown and to see how these fees apply in a real-world scenario, get a free guide now from Augusta Precious Metals.

Evaluating Fee Transparency

One of the most important factors when choosing a gold IRA provider is fee transparency. Companies that are upfront about their complete fee structure typically offer better value and fewer surprises.

Questions to Ask About Fees

When researching gold IRA companies, ask these specific questions to ensure you understand the full cost picture:

- “Can you provide a complete written fee schedule that includes all potential charges?”

- “Are there any circumstances under which fees might increase?”

- “Do you offer any fee waivers or discounts for larger accounts?”

- “How and when are fees collected from my account?”

- “Are storage fees included in the annual maintenance fee or charged separately?”

- “What is your dealer markup on precious metals purchases?”

- “Are there any fees that might apply in my specific situation that we haven’t discussed?”

Best Precious Metals Companies of 2026

A quick side-by-side snapshot of minimums, fees, and what makes each provider stand out—so you can choose faster and request a free kit.

Augusta Precious Metals

GoldenCrest Metals

Noble Gold Investments

Birch Gold Group

Lear Capital

Calculating Your Total Gold IRA Costs

To accurately assess whether a gold IRA makes financial sense for your situation, it’s helpful to calculate your expected total costs over time.

First-Year Costs Example

For a $100,000 gold IRA investment, your first-year costs might include:

| Fee Type | Typical Cost |

| Setup Fee | $50 |

| Annual Administration | $125 |

| Storage (Non-segregated) | $100 |

| Initial Transaction Fee | $40 |

| Total First Year | $315 (0.315% of assets) |

Ongoing Annual Costs

After the first year, your annual costs would typically drop to around $225 (0.225% of assets) for the same account, assuming no additional transactions.

“When evaluating gold IRA costs, consider the long-term perspective. While fees may seem high in absolute terms, they often represent a small percentage of larger accounts and can be justified by the portfolio diversification benefits that physical gold provides.”

Conclusion: Are Gold IRA Fees Worth It?

Gold IRA fees are higher than those of traditional IRAs due to the additional requirements of handling and storing physical precious metals. However, these costs should be evaluated in the context of the potential benefits that gold can bring to your retirement portfolio—particularly diversification, inflation protection, and wealth preservation during economic uncertainty.

For many investors, especially those with larger accounts where fees represent a smaller percentage of assets, the additional costs are justified by these benefits. The key is to choose a provider with transparent fees, competitive pricing, and excellent service.

Before opening a gold IRA, take time to thoroughly research providers, understand all associated fees, and calculate how these costs will impact your long-term returns. This due diligence will help ensure that your precious metals investment enhances rather than detracts from your retirement security.

Ready to Learn More About Gold IRA Fees?

For a detailed breakdown and to see how these fees apply in a real-world scenario, get a free guide now from Augusta Precious Metals. Their experts can help you understand the complete cost picture and determine if a gold IRA is right for your retirement strategy.

Frequently Asked Questions About Gold IRA Fees

Are gold IRA fees tax-deductible?

No, IRS regulations do not allow you to deduct gold IRA fees from your taxes. These fees are typically paid directly from your IRA account, which means you’re effectively using pre-tax dollars (in a Traditional IRA) to cover these expenses.

How do gold IRA fees compare to ETF expense ratios?

Gold ETFs typically have lower expense ratios (usually 0.25% to 0.50% annually) compared to the total fees of physical gold IRAs. However, ETFs don’t provide direct ownership of physical gold, which some investors prefer for greater security and control.

Can I negotiate gold IRA fees?

Some gold IRA providers may be willing to negotiate certain fees, particularly for larger accounts. It’s always worth asking if any fees can be reduced or waived, especially if you’re transferring a substantial amount.

What happens to my gold IRA if I don’t pay the fees?

If you fail to pay your gold IRA fees, the custodian may liquidate a portion of your holdings to cover the outstanding fees. In extreme cases, they might close your account and distribute the assets, which could trigger taxes and penalties if you’re under 59½.

Are there any gold IRA companies that don’t charge fees?

No reputable gold IRA company can offer completely fee-free services due to the real costs of administration, storage, and insurance. Companies advertising “no fees” typically build these costs into their precious metals pricing through higher markups.