In times of economic uncertainty, investors often turn to gold as a safe-haven asset. Its enduring value has withstood the test of time, offering a potential hedge against inflation and market volatility. If you’re considering adding gold to your investment portfolio, you face an important decision: should you invest through a Gold IRA or purchase physical gold directly?

Both options provide exposure to this precious metal, but they differ significantly in terms of storage requirements, accessibility, tax implications, and overall control. Understanding these differences is crucial for making an informed decision that aligns with your financial goals and investment strategy.

This comprehensive guide examines the key distinctions between Gold IRAs and physical gold ownership, helping you determine which approach best suits your needs during these unpredictable economic times.

Considering a Gold IRA? Start With the Free Augusta Guide

If you’re comparing a Gold IRA vs. buying physical gold, the fastest way to get clarity is to review how IRS rules, storage, and distributions actually work. Augusta Precious Metals offers a free guide that breaks it down step-by-step.

Understanding Gold IRA vs Physical Gold: The Basics

What is a Gold IRA?

A Gold IRA (Individual Retirement Account) is a self-directed IRA that allows you to hold physical precious metals as retirement investments. Unlike conventional IRAs that typically contain stocks, bonds, or mutual funds, a Gold IRA gives you the ability to own IRS-approved gold coins, bars, and bullion within a tax-advantaged retirement account.

Gold IRAs come in two primary varieties: Traditional Gold IRAs, which offer tax-deductible contributions with taxes paid upon withdrawal, and Roth Gold IRAs, where contributions are made with after-tax dollars but qualified withdrawals are tax-free. Both types require a custodian to manage the account and ensure compliance with IRS regulations.

The IRS has strict requirements regarding the types of gold that can be held in these accounts. Generally, gold must be at least 99.5% pure, with few exceptions like American Gold Eagles. Additionally, all precious metals in a Gold IRA must be stored in an IRS-approved depository, not in your personal possession.

What is Physical Gold Ownership?

Physical gold ownership refers to the direct purchase and possession of gold in tangible forms such as coins, bars, or bullion. When you buy physical gold, you take immediate possession of the metal, storing it wherever you choose—whether in a home safe, bank safe deposit box, or private vault facility.

This direct ownership gives you complete control over your gold assets without the involvement of a custodian or third party. You can buy and sell your gold whenever you wish, and you have immediate access to it at all times. Popular forms of physical gold include American Eagles, Canadian Maple Leafs, South African Krugerrands, and gold bars of various weights and sizes.

Unlike gold in an IRA, personally owned physical gold doesn’t come with tax advantages. However, it does offer the security of having a tangible asset in your direct possession, which many investors find appealing, especially during times of economic uncertainty.

Get the IRA Rules, Storage Requirements, and Setup Steps (Free)

If you’re leaning toward using retirement funds for gold, Augusta’s free kit explains eligible metals, IRS storage rules, and what a rollover typically looks like—before you commit to anything.

Storage and Security: How Your Gold is Protected

Gold IRA Storage Requirements

When you invest in a Gold IRA, the IRS mandates that your precious metals must be stored in an approved depository. This requirement exists to ensure the security of your retirement assets and maintain the tax-advantaged status of your account.

These depositories are specialized facilities with advanced security systems, including 24/7 monitoring, armed guards, and sophisticated alarm systems. They also carry comprehensive insurance policies that protect your assets against theft, damage, or loss.

Your gold is typically held in segregated storage, meaning your specific coins or bars are kept separate from other investors’ holdings and remain your property. The depository conducts regular audits and provides verification of your holdings, giving you peace of mind about the security of your investment.

While this arrangement ensures maximum security, it also means you cannot physically access your gold whenever you want. Any withdrawal or transaction must go through your custodian, adding an extra layer of administration to the process.

Physical Gold Storage Options

With direct ownership of physical gold, you have complete flexibility in how you store your precious metals. Many investors choose to keep their gold in a home safe, providing immediate access but potentially increasing security risks.

Bank safe deposit boxes are another popular option, offering improved security over home storage. However, these boxes may not be accessible outside of banking hours, and contrary to common belief, the contents are typically not insured by the bank or FDIC.

Private vault facilities represent a middle ground between home storage and IRA depositories. These facilities offer professional security and often include insurance, but with more flexible access than IRA-approved depositories.

Regardless of which storage method you choose for physical gold, you’ll need to consider insurance costs. Standard homeowner’s policies usually have limited coverage for precious metals, so additional insurance may be necessary to fully protect your investment.

| Storage Feature | Gold IRA | Physical Gold |

| Location Options | IRS-approved depositories only | Home safe, bank safe deposit box, private vault |

| Security Level | Maximum (24/7 monitoring, armed guards) | Varies based on storage choice |

| Insurance | Included with depository storage | Additional policies often needed |

| Accessibility | Limited, requires custodian approval | Immediate (home) or during business hours (bank) |

| Audit/Verification | Regular professional audits | Self-managed |

Understand IRS-Approved Depository Storage (Free Guide)

If you prefer the added security of insured depository storage (instead of self-storage), Augusta’s kit explains how IRA storage works, what’s allowed, and what to expect.

Access and Liquidity: When and How You Can Use Your Gold

Accessing Gold in an IRA

Gold held within an IRA is subject to the same distribution rules as any other retirement account. If you withdraw before age 59½, you’ll typically face a 10% early withdrawal penalty in addition to paying income tax on the distribution (for Traditional IRAs).

The process of accessing your gold isn’t immediate. You’ll need to contact your custodian, complete the necessary paperwork, and wait for the transaction to be processed. This can take several days or even weeks, depending on your custodian’s procedures.

When you reach age 73 (as of 2023 regulations), you’ll face Required Minimum Distributions (RMDs) with a Traditional Gold IRA. This means you must begin taking distributions, which can be complicated with physical assets like gold. You may need to sell a portion of your gold to meet these requirements, potentially at unfavorable market prices.

If you want to take physical possession of your gold from an IRA, it’s considered a distribution and taxed accordingly. You cannot simply move the gold from the depository to your home without tax consequences.

Accessing Physical Gold

One of the primary advantages of owning physical gold directly is immediate accessibility. If you store your gold at home, you can access it at any time without paperwork, approvals, or waiting periods.

This immediate access can be particularly valuable during emergencies or times of economic crisis when having tangible assets on hand might provide peace of mind or practical utility.

When you decide to sell physical gold, you have multiple options. You can sell to local coin shops, online dealers, or private buyers. The process is straightforward and can often be completed in a single day, though you’ll want to shop around for the best price.

Unlike IRA-held gold, there are no age-based requirements for buying or selling physical gold. You can purchase at any age and sell whenever you choose, giving you complete flexibility throughout your lifetime.

Gold IRA Liquidity Advantages

- Tax-advantaged growth potential

- Professional verification of authenticity

- Potential for easier large-volume transactions

- No need to find buyers yourself

- Protection from impulse selling during market dips

Gold IRA Liquidity Challenges

- Early withdrawal penalties before age 59½

- Required Minimum Distributions after age 73

- Administrative delays in processing transactions

- Potential forced selling to meet RMD requirements

- Limited flexibility during economic emergencies

Learn How Withdrawals and RMDs Work in a Gold IRA

Before you decide, it helps to understand the retirement account rules. Augusta’s free guide covers distributions, IRA logistics, and how investors typically structure a rollover.

Costs and Fees: Understanding the Financial Impact

Gold IRA Cost Structure

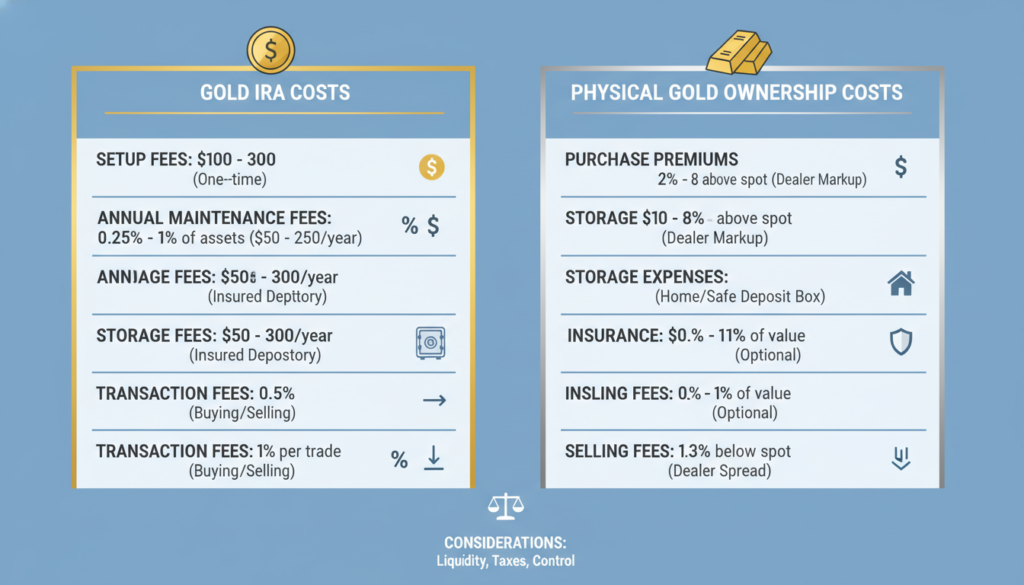

Investing in a Gold IRA involves several layers of fees that can impact your overall returns. Understanding these costs is essential for making an informed decision about whether this investment vehicle is right for you.

The first expense you’ll encounter is the account setup fee, which typically ranges from $50 to $150. This one-time charge covers the administrative work of establishing your self-directed IRA with a qualified custodian.

Annual maintenance fees are ongoing charges for the administration of your account. These fees generally range from $75 to $300 per year, depending on the custodian and the complexity of your account.

Storage fees are charged by the depository where your gold is held. These fees usually amount to 0.5% to 1% of the value of your stored metals annually. Some depositories charge a flat fee instead, which might be more economical for larger holdings.

Transaction fees apply whenever you buy or sell gold within your IRA. These can include wire transfer fees, processing fees, and shipping/insurance costs for moving the metals to or from the depository.

When purchasing gold for your IRA, you’ll also pay a markup over the spot price of gold. This premium varies by product and dealer but typically ranges from 2% to 10% above the market price of gold.

Physical Gold Ownership Costs

Owning physical gold directly also comes with costs, though they differ from those associated with a Gold IRA. The most significant initial cost is the premium you pay over the spot price when purchasing gold coins or bars.

These premiums vary widely based on the type of gold product. Government-minted coins like American Eagles typically command higher premiums (5-10% above spot) than standard gold bars (3-5% above spot). Rare or collectible coins can carry much higher premiums based on their numismatic value.

If you choose to store your gold in a bank safe deposit box, you’ll pay annual rental fees that typically range from $30 to $200, depending on the box size and your location.

Private vault storage is another option, with annual fees similar to those charged by IRA depositories (approximately 0.5% to 1% of the value of your gold).

Insurance costs are an important consideration for home-stored gold. You may need a special rider on your homeowner’s policy or a separate valuable items policy, which can cost 1% to 2% of the insured value annually.

When selling physical gold, you’ll typically receive less than the current spot price. This “buy-back spread” effectively represents another cost of ownership and can range from 1% to 5% below the market price.

| Fee Type | Gold IRA | Physical Gold |

| Initial Setup | $50-$150 account setup | None (beyond purchase premium) |

| Annual Maintenance | $75-$300 | None for home storage |

| Storage | 0.5%-1% of asset value annually | $30-$200 (safe deposit box) or 0.5%-1% (private vault) |

| Insurance | Included in depository fees | 1%-2% of value annually for home storage |

| Transaction Costs | Wire fees, processing fees | None after purchase |

| Purchase Premium | 2%-10% above spot price | 3%-10% above spot price |

| Selling Discount | Varies by custodian/dealer | 1%-5% below spot price |

Get a Transparent Gold IRA Cost Overview (Free)

Augusta’s free kit helps you understand common IRA fee categories and what to look for, so you can compare Gold IRA costs against the expenses of owning physical gold directly.

Control and Flexibility: Managing Your Gold Investment

Control Aspects of a Gold IRA

A Gold IRA offers a structured approach to precious metals investing within the framework of retirement planning. While you have control over which IRS-approved gold products to purchase, there are significant limitations on how you can interact with your investment.

The requirement to work through a custodian means that all transactions must be approved and processed by a third party. This adds a layer of administration that can slow down decision-making and implementation.

You cannot take physical possession of the gold in your IRA without triggering a taxable distribution. This means you can’t simply decide to bring some of your gold home during uncertain times—doing so would have tax consequences and potentially incur penalties.

The types of gold you can purchase are limited to those that meet IRS purity standards (generally 99.5% pure). This excludes many collectible or numismatic coins that might otherwise be of interest to gold investors.

On the positive side, a Gold IRA allows you to combine the tax advantages of retirement accounts with the potential benefits of gold ownership. This structure can be particularly valuable for long-term wealth building and retirement planning.

Control Aspects of Physical Gold

Direct ownership of physical gold offers maximum control and flexibility. You decide exactly what to buy, where to store it, and when to sell it, without requiring approval from a custodian or adhering to IRA regulations.

You can purchase any type of gold that interests you, including collectible coins, jewelry, or other items that wouldn’t qualify for an IRA. This opens up a wider range of investment options and potential opportunities.

Having immediate physical access to your gold means you can respond quickly to changing market conditions or personal circumstances. If you need to liquidate some holdings, you can do so without paperwork or waiting periods.

You can divide and use your gold however you choose. For example, you might sell a portion, gift some to family members, or even use it for barter in extreme circumstances—options that aren’t available with IRA-held gold.

This level of control comes with greater responsibility. You must research products, verify authenticity, arrange secure storage, and manage all aspects of your gold investment without the guidance or oversight that comes with a custodial relationship.

“The key difference between a Gold IRA and physical gold ownership isn’t just about tax benefits—it’s about who ultimately controls your precious metals and how quickly you can access them when needed.”

Tax Implications: Understanding the Financial Consequences

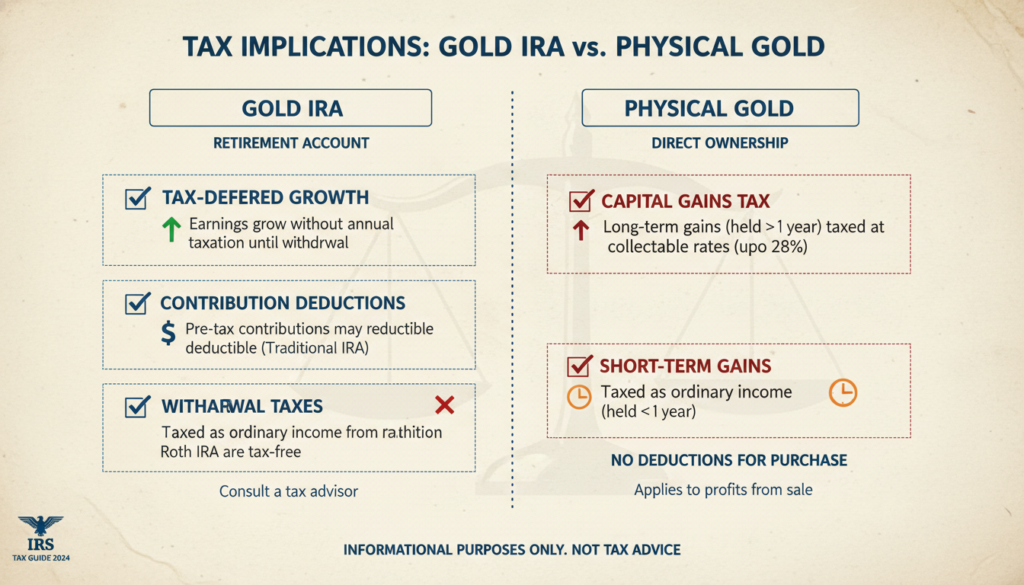

Gold IRA Tax Benefits

One of the primary advantages of a Gold IRA is its tax-advantaged status. With a Traditional Gold IRA, your contributions may be tax-deductible, reducing your taxable income for the year you make the contribution. This immediate tax benefit can be significant, especially for those in higher tax brackets.

As your gold appreciates in value within the IRA, you won’t pay any taxes on these gains. This tax-deferred growth allows your investment to compound more efficiently over time compared to taxable investments.

When you eventually take distributions from a Traditional Gold IRA, they’re taxed as ordinary income. If you’re in a lower tax bracket during retirement than during your working years, this can result in overall tax savings.

With a Roth Gold IRA, while you don’t get an immediate tax deduction for contributions, qualified withdrawals in retirement are completely tax-free. This can be particularly advantageous if you expect gold to appreciate significantly over time.

It’s important to note that early withdrawals (before age 59½) typically incur a 10% penalty in addition to any taxes due. This reinforces the long-term nature of IRA investments.

Physical Gold Tax Considerations

The IRS classifies physical gold as a “collectible” for tax purposes, regardless of whether you own coins, bars, or bullion. This classification has significant implications for how your investment is taxed.

When you sell physical gold at a profit, you’ll owe capital gains tax. If you’ve held the gold for more than one year, it’s considered a long-term capital gain and taxed at a maximum rate of 28%—higher than the 15% or 20% maximum rates that apply to most other long-term capital assets.

For gold held less than one year, profits are taxed as ordinary income, which could be as high as 37% depending on your tax bracket.

Unlike with an IRA, there are no tax benefits for purchasing physical gold. You can’t deduct the cost from your income taxes, and you’ll pay the full tax rate on any gains when you sell.

On the positive side, there are no required minimum distributions or age-based withdrawal rules with physical gold. You can hold it indefinitely without tax consequences until you decide to sell.

Important Tax Reporting Note: When selling physical gold, dealers may be required to report the transaction to the IRS using Form 1099-B for certain types and quantities of precious metals. Always maintain good records of your purchase prices and dates to accurately calculate your tax liability when selling.

Tax Benefits Matter? Compare the IRA Option First

If you want potential tax advantages and retirement-account structure, Augusta’s free kit helps you evaluate whether a Gold IRA fits your situation compared to buying physical gold outright.

Which Option is Right for You? Matching Gold Investment to Your Goals

Ideal Scenarios for Gold IRA Investors

A Gold IRA may be the better choice if you’re primarily focused on long-term retirement planning. The tax advantages can significantly enhance your returns over decades, especially if you expect to be in a lower tax bracket during retirement.

If you already have substantial retirement savings in traditional IRAs or 401(k)s, a Gold IRA offers a way to diversify these tax-advantaged funds into precious metals without triggering immediate tax consequences through a rollover.

Investors who value security and professional management often prefer Gold IRAs. The combination of IRS-approved depositories, regular audits, and comprehensive insurance provides peace of mind about the safety and authenticity of your gold holdings.

Those who might be tempted to make emotional decisions during market volatility may benefit from the structural barriers to immediate access that come with a Gold IRA. The administrative steps required to sell can provide a cooling-off period during market panics.

If you’re concerned about the logistics of securely storing physical gold yourself, a Gold IRA eliminates this worry by placing the responsibility with professional depositories.

Ideal Scenarios for Physical Gold Ownership

Direct ownership of physical gold may be preferable if immediate access and maximum control are your priorities. Having gold in your possession provides a sense of security that some investors find invaluable, especially during times of economic or political uncertainty.

If you’re investing in gold as a hedge against severe economic disruption or currency devaluation, physical possession ensures you maintain access to your assets regardless of the functioning of financial institutions or custodians.

Investors who may need to liquidate their gold holdings before retirement age might prefer physical gold to avoid the early withdrawal penalties associated with IRAs.

Those interested in numismatic or collectible coins, which often aren’t eligible for IRAs, will need to pursue physical ownership to invest in these items.

If you prefer to avoid the ongoing fees associated with Gold IRAs, direct ownership might be more economical, especially for smaller gold holdings where annual fees would represent a significant percentage of the investment value.

Consider a Balanced Approach

Many experienced investors choose to incorporate both strategies into their overall financial plan. You might maintain a Gold IRA as part of your long-term retirement strategy while also keeping some physical gold for immediate access and peace of mind.

This balanced approach allows you to benefit from the tax advantages of an IRA while still maintaining the security and flexibility of having some gold in your direct possession.

The proportion of each would depend on your individual circumstances, including your age, tax situation, retirement timeline, and personal comfort with different storage options.

Practical Steps: How to Get Started with Gold Investing

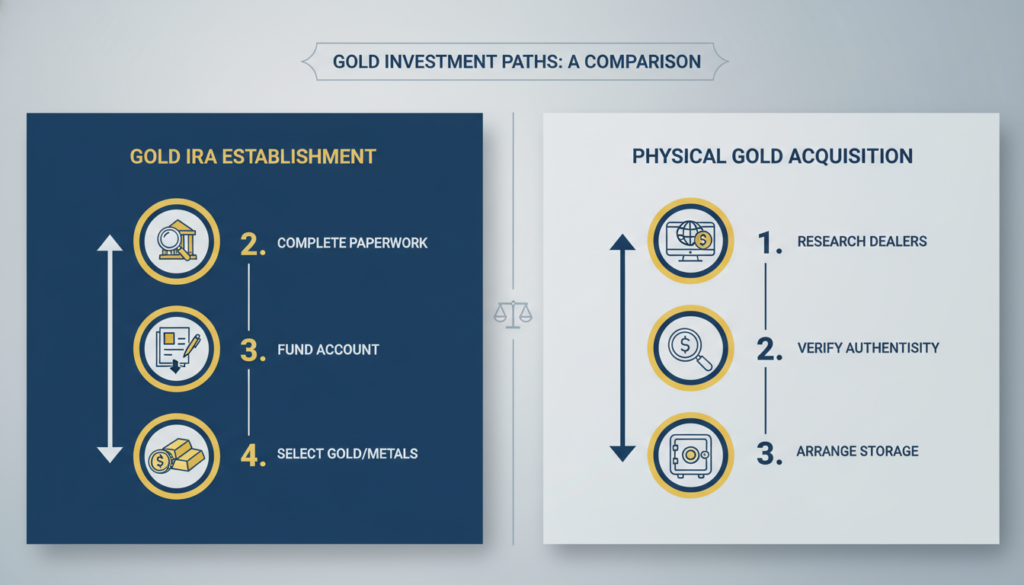

Setting Up a Gold IRA

If you’ve decided a Gold IRA is right for you, the first step is to find a reputable custodian that specializes in self-directed IRAs. Look for companies with strong track records, transparent fee structures, and excellent customer service.

Once you’ve selected a custodian, you’ll need to complete the account application and setup process. This typically involves providing identification, beneficiary information, and signing various agreements.

Next, you’ll fund your Gold IRA. This can be done through a direct contribution (subject to annual limits), a transfer from another IRA, or a rollover from a qualified retirement plan like a 401(k).

After your account is funded, you’ll work with your custodian to select IRS-approved gold products for purchase. The custodian will arrange the purchase and delivery of these metals to an approved depository.

Finally, you’ll need to choose a storage option at an IRS-approved depository. Your custodian can help you understand the available options and associated costs.

Purchasing Physical Gold

To buy physical gold directly, start by researching reputable dealers. Look for established companies with positive reviews, competitive pricing, and a history of ethical business practices.

Decide which type of gold products you want to purchase. Common options include government-minted coins like American Eagles or Canadian Maple Leafs, private mint products, or gold bars of various sizes.

Compare prices from multiple dealers to ensure you’re getting a fair deal. Remember that all dealers charge a premium over the spot price of gold, but these premiums can vary significantly.

Before finalizing your purchase, verify the authenticity and purity of the gold products. Reputable dealers should provide assurances and certificates of authenticity.

Finally, determine your storage strategy. Whether you choose home storage, a bank safe deposit box, or a private vault, make sure you have a secure plan in place before your gold arrives.

How much gold should I consider adding to my portfolio?

Financial advisors often recommend allocating between 5% and 15% of your investment portfolio to precious metals like gold. This provides diversification benefits without overexposure to a single asset class. Your specific allocation should depend on your risk tolerance, investment timeline, and overall financial goals.

Can I convert my existing physical gold into a Gold IRA?

Generally, no. IRS regulations prohibit moving your existing physical gold directly into an IRA. This would be considered a “self-dealing” transaction. Instead, you would need to sell your current gold, contribute the cash to your IRA, and then have your custodian purchase new gold that meets IRS requirements.

What happens to my Gold IRA when I reach retirement age?

When you reach age 59½, you can begin taking distributions from your Gold IRA without early withdrawal penalties. With a Traditional Gold IRA, you’ll pay income tax on distributions, and after age 73, you’ll need to take Required Minimum Distributions (RMDs). With a Roth Gold IRA, qualified distributions are tax-free, and there are no RMDs during your lifetime.

Ready for the Next Step?

If you’re leaning toward using retirement funds for gold, Augusta’s free guide walks you through the process, what’s eligible, and what to expect—so you can make a confident decision.

Conclusion: Making the Right Choice for Your Financial Future

When deciding between a Gold IRA and physical gold ownership, there’s no one-size-fits-all answer. Both options offer exposure to gold’s potential benefits as a store of value and hedge against economic uncertainty, but they do so in fundamentally different ways.

A Gold IRA provides tax advantages and professional management, making it well-suited for long-term retirement planning. The structured nature of an IRA, with its regulated storage requirements and distribution rules, creates a disciplined approach to gold investing that many find beneficial for wealth preservation over decades.

Physical gold ownership offers maximum control and immediate access, appealing to those who value direct possession of tangible assets. The flexibility to buy, sell, or use your gold without intermediaries or age-based restrictions provides a level of independence that many investors find reassuring, especially during uncertain economic times.

Your choice should align with your financial goals, investment timeline, tax situation, and personal preferences regarding control versus convenience. Many sophisticated investors incorporate both approaches into their overall financial strategy, leveraging the unique advantages of each.

Whichever path you choose, understanding the key differences in storage, access, costs, and tax implications is essential for making an informed decision that supports your long-term financial well-being.

Best Precious Metals Companies of 2026

A quick side-by-side snapshot of minimums, fees, and what makes each provider stand out—so you can choose faster and request a free kit.

Augusta Precious Metals

GoldenCrest Metals

Noble Gold Investments

Birch Gold Group

Lear Capital

Ready to Learn More About Gold Investing?

Discover insider strategies and expert insights on gold investing with our comprehensive guide. Whether you’re considering a Gold IRA or physical gold ownership, this free resource will help you make informed decisions about protecting your wealth.