Planning for retirement involves navigating a fundamental tension: the need for continued growth to outpace inflation versus the increasing importance of capital preservation as your earning years wind down. This balancing act becomes even more critical during periods of market volatility, inflation concerns, and economic uncertainty. Gold and stocks represent two distinct approaches to addressing this challenge, each with unique risk profiles and potential benefits for retirement portfolios.

Understanding how these assets behave—both independently and in relation to each other—can help you build a more resilient retirement strategy that withstands market fluctuations while still providing the growth needed for a comfortable retirement. Let’s explore how gold and stocks compare as retirement assets and how they might work together in your portfolio.

Gold and stocks represent different approaches to retirement investing, each with distinct risk and return characteristics.

Want a Simple Retirement-Focused Gold IRA Overview?

If you’re evaluating gold vs. stocks for retirement, it helps to understand how physical precious metals can fit inside a tax-advantaged account. Augusta Precious Metals provides a free guide covering Gold IRAs, eligible metals, rollover basics, and what retirement investors typically consider before reallocating.

Or speak with a specialist:

Volatility and Stability: Contrasting Risk Profiles

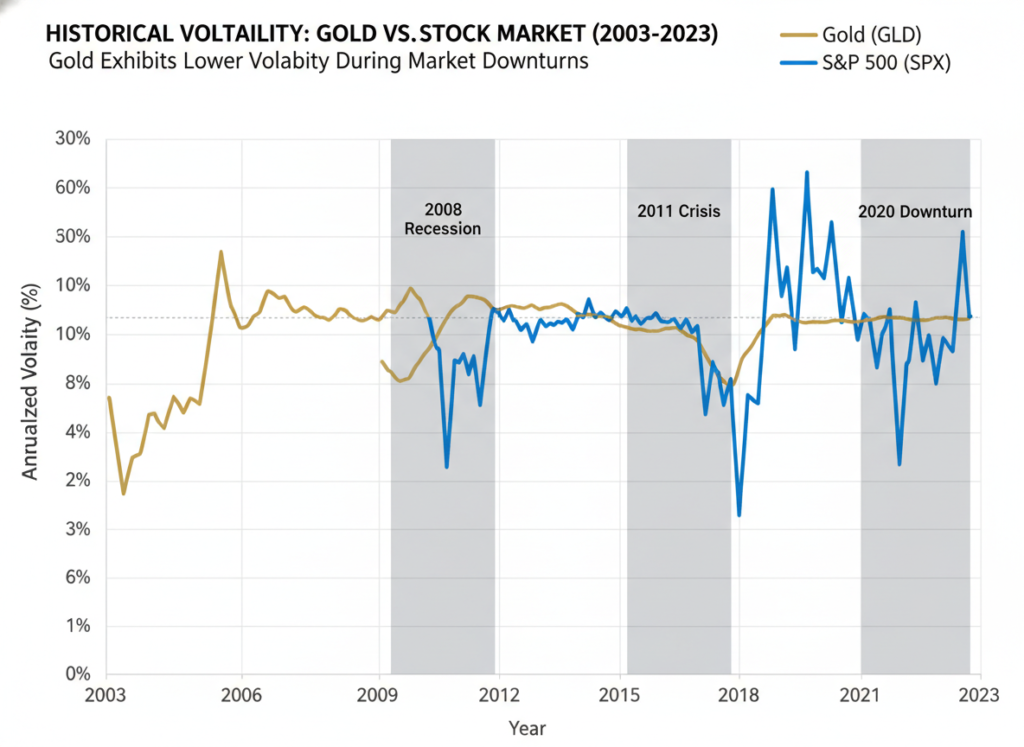

When evaluating gold vs stocks in retirement portfolios, understanding their different volatility patterns is essential for managing overall risk exposure.

Historical volatility comparison shows how gold often moves independently from stock market fluctuations.

Stock Market Volatility

The stock market historically delivers strong long-term returns but comes with significant short-term price swings. During the 2008 financial crisis, the S&P 500 dropped by over 50%, and in March 2020, markets fell by more than 30% in just a few weeks. This volatility can be particularly concerning for retirees who may not have the time horizon to recover from major drawdowns.

Gold’s Stability Function

Gold has traditionally served as a stabilizing force during periods of market stress. When stocks experienced sharp declines during the 2008 financial crisis, gold prices increased by approximately 25%. Similarly, during the COVID-19 market crash, while stocks plummeted, gold maintained its value and subsequently reached all-time highs.

This counter-cyclical behavior makes gold particularly valuable in retirement portfolios where preservation of capital becomes increasingly important. While gold can experience its own price fluctuations, these movements often occur independently of stock market cycles, providing true diversification rather than just variety in a portfolio.

Gold’s value tends to be stable and can even rise during times of economic instability or inflation, making it a safe haven for investors. It is less affected by economic cycles and market fluctuations, providing a cushion against market downturns.

Looking for a Portfolio “Stabilizer” as You Near Retirement?

If reducing drawdown risk is a priority, Augusta’s free kit explains how many retirement investors use a modest precious-metals allocation and what a Gold IRA rollover typically involves.

Or call:

Growth Potential vs. Wealth Preservation

Retirement portfolios must balance the need for continued growth with the increasing importance of preserving accumulated wealth. Stocks and gold serve distinctly different functions in addressing these dual needs.

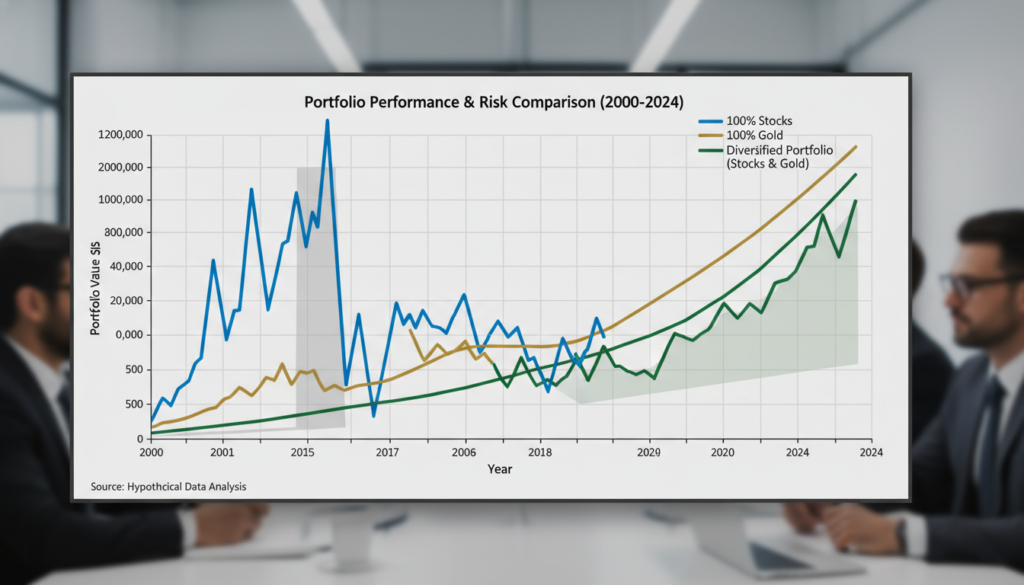

Evaluating the long-term performance of different assets is crucial for retirement planning.

Stocks as Growth Engines

Stocks represent ownership in companies that can grow, innovate, and generate profits. Historically, the stock market has delivered average annual returns of around 10% before inflation, outpacing most other asset classes over very long periods. This growth potential makes stocks essential for building wealth and combating inflation, even during retirement years that might span decades.

However, this growth comes with inherent cycles of expansion and contraction. Market corrections and bear markets are inevitable features of stock investing, creating significant risk for retirees who may be drawing down their portfolios during market downturns.

Gold as a Store of Value

Gold’s primary function in a portfolio is wealth preservation rather than aggressive growth. Throughout history, gold has maintained its purchasing power over very long time horizons, often strengthening during periods of currency devaluation, inflation, and geopolitical stress.

While gold doesn’t pay dividends or generate cash flow, its role as a store of value becomes increasingly important in retirement when the focus shifts from accumulation to preservation and income generation. Gold’s ability to maintain purchasing power can help protect against the erosion of retirement savings due to inflation or currency devaluation.

Stocks: Advantages

- Higher long-term growth potential

- Dividend income possibilities

- Ownership in productive businesses

- Liquidity and ease of trading

- More favorable long-term tax treatment

Stocks: Disadvantages

- Higher short-term volatility

- Vulnerable to economic downturns

- Susceptible to sector-specific risks

- Can experience prolonged bear markets

- May perform poorly during inflation

Gold: Advantages

- Store of value during inflation

- Portfolio stabilizer during market stress

- Non-correlation with stocks and bonds

- Protection against currency devaluation

- Tangible asset with no counterparty risk

Gold: Disadvantages

- No dividend or interest payments

- Storage and insurance costs (physical gold)

- Less favorable tax treatment (28% collectible rate)

- Can experience long periods of flat performance

- Subject to supply/demand fluctuations

Comparing Physical Gold vs. a Gold IRA?

If you want to explore retirement-account options for precious metals, Augusta’s guide explains eligible products, storage requirements, and how rollovers generally work so you can make a more informed choice.

Or call:

The Diversification Benefit: Reducing Portfolio Volatility

Perhaps the most compelling reason to consider both gold and stocks in retirement is the powerful diversification benefit they provide when combined strategically.

A diversified portfolio combining gold and stocks typically shows reduced volatility compared to either asset alone.

The Power of Non-Correlation

Gold and stocks typically have a low or negative correlation, meaning they often move in different directions, particularly during periods of market stress. This non-correlation is what makes gold such an effective diversifier in a stock-heavy retirement portfolio.

Research has shown that portfolios containing both stocks and a modest allocation to gold (typically 5-15%) have historically experienced lower volatility and smaller maximum drawdowns than portfolios containing only stocks. This reduction in overall portfolio volatility can be particularly valuable for retirees who are making regular withdrawals from their portfolios.

By combining gold and stocks, investors could achieve a more balanced and resilient portfolio. Gold provides a counterbalance to the inherent volatility of investing in stocks, reducing overall risk.

Enhanced Risk-Adjusted Returns

Beyond simply reducing volatility, the right allocation to gold can actually improve risk-adjusted returns. This means getting better returns relative to the amount of risk taken, which is especially important in retirement when recovery time from losses is limited.

Studies have shown that portfolios with a modest gold allocation have historically achieved similar or better long-term returns than all-stock portfolios, but with significantly less volatility and smaller maximum drawdowns. This improvement in the risk-return profile can help retirees sleep better at night while still maintaining the growth potential needed to fund a potentially lengthy retirement.

If You’re Ready to Compare Providers, Start With a Free Gold IRA Kit

Augusta Precious Metals is known for education-first support and a clear rollover process. Their free kit is a solid starting point if you’re evaluating a Gold IRA for diversification.

Or call:

Best Precious Metals Companies of 2026

A quick side-by-side snapshot of minimums, fees, and what makes each provider stand out—so you can choose faster and request a free kit.

Augusta Precious Metals

GoldenCrest Metals

Noble Gold Investments

Birch Gold Group

Lear Capital

Liquidity and Income Considerations

Both liquidity (the ability to convert assets to cash quickly) and income generation are important factors for retirement portfolios. Stocks and gold offer different advantages in these areas.

Income generation becomes increasingly important during the distribution phase of retirement.

Stock Market Liquidity and Income

Stocks traded on major exchanges offer excellent liquidity, with the ability to convert to cash within days. More importantly for retirees, many stocks pay dividends, providing a regular income stream without needing to sell the underlying asset. Dividend-paying stocks can be particularly valuable in retirement portfolios, offering both income and continued growth potential.

The S&P 500 currently yields around 1.5% in dividends, with many individual stocks offering yields of 3-5% or higher. This income can help fund retirement expenses while allowing the principal to remain invested for continued growth.

Gold Liquidity and Income Limitations

Gold is also highly liquid, especially when held in the form of exchange-traded funds (ETFs) or through major dealers if held physically. However, unlike stocks, gold does not generate income in the form of dividends or interest. The only way to realize gains from gold is to sell it at a higher price than you paid.

This lack of income generation is often cited as gold’s biggest drawback for retirement portfolios. However, this limitation needs to be weighed against gold’s other benefits, particularly its role as a portfolio stabilizer and inflation hedge.

| Feature | Stocks | Gold |

| Income Generation | Dividends (1.5-5% average yield) | None (capital appreciation only) |

| Liquidity | High (1-3 days settlement) | High (ETFs) to Moderate (physical) |

| Transaction Costs | Low (typically under 0.5%) | Moderate to High (1-5% for physical) |

| Storage Requirements | None (digital) | Yes for physical (secure vault/safe) |

| Insurance Needs | None (SIPC protection) | Yes for physical holdings |

Prefer a Retirement Account Structure for Gold?

If you’re weighing physical gold vs. a Gold IRA, Augusta’s free guide explains account rules, storage, and how retirement investors commonly allocate metals for diversification.

Or call:

Practical Considerations for Retirement Portfolios

Implementing a strategy that incorporates both gold and stocks requires careful consideration of allocation percentages, investment vehicles, and how these might change throughout retirement.

Working with a financial advisor can help determine the optimal allocation between gold and stocks for your specific retirement needs.

Allocation Strategies

Research suggests that a gold allocation of 5-15% provides the optimal diversification benefit in most retirement portfolios. This modest allocation is typically enough to provide meaningful downside protection during market stress without significantly reducing the portfolio’s long-term growth potential.

The exact percentage should be tailored to your specific situation, including factors like:

- Your age and retirement timeline

- Overall risk tolerance

- Other income sources (pensions, Social Security)

- Current economic conditions and inflation outlook

- Your view on future geopolitical stability

Investment Vehicles

There are several ways to add gold exposure to a retirement portfolio, each with distinct advantages:

Physical Gold

Coins and bars held in your possession or in allocated storage. Provides direct ownership with no counterparty risk, but requires secure storage and insurance.

Gold ETFs

Exchange-traded funds that track the price of gold. Offers convenience and liquidity without storage concerns, but introduces counterparty risk and ongoing expense ratios.

Gold IRAs

Tax-advantaged retirement accounts holding physical gold. Combines direct ownership with tax benefits, though with additional costs and restrictions on eligible products.

Different gold investment vehicles offer varying levels of direct ownership, convenience, and tax advantages.

Retirement Phases and Changing Allocations

Your optimal allocation to gold vs stocks may change throughout different phases of retirement:

Accumulation Phase (Pre-Retirement)

During your working years, a higher allocation to stocks (70-80%) with a smaller gold position (5-10%) may be appropriate to maximize growth while still providing some portfolio insurance.

Early Retirement (First 5-10 Years)

As you enter retirement, increasing gold allocation slightly (10-15%) can help protect against sequence-of-returns risk—the danger of experiencing major market downturns early in retirement when your portfolio is largest.

Later Retirement

In later retirement stages, maintaining a moderate gold allocation (10-15%) continues to provide important diversification as the focus shifts increasingly toward capital preservation and steady income.

Considering a 5–15% Gold Allocation? Get the Steps in Writing

Augusta’s free kit explains rollover steps, storage basics, and how retirement investors typically structure a Gold IRA when they want diversification and long-term purchasing-power protection.

Or call:

Tax Implications for Retirement Investors

Tax efficiency is an important consideration for retirement portfolios, and gold and stocks are treated differently under current tax law.

Understanding the tax implications of different assets can significantly impact retirement portfolio returns.

Stock Tax Treatment

Stocks held for more than one year qualify for long-term capital gains rates, which are more favorable than ordinary income rates. These rates are currently 0%, 15%, or 20%, depending on your income level. Additionally, qualified dividends receive the same preferential tax treatment.

Stocks held in tax-advantaged retirement accounts like traditional IRAs or 401(k)s grow tax-deferred, with taxes paid upon withdrawal at ordinary income rates. Roth accounts offer tax-free growth and withdrawals if certain conditions are met.

Gold Tax Treatment

Physical gold is classified as a “collectible” by the IRS, subject to a maximum long-term capital gains rate of 28%—higher than the rate applied to stocks. This less favorable tax treatment is an important consideration when holding physical gold in taxable accounts.

However, gold held within a Gold IRA receives the same tax-advantaged treatment as other IRA assets, allowing for tax-deferred or tax-free growth depending on whether it’s a traditional or Roth account. This can significantly improve the after-tax returns of gold investments.

Tax-Efficient Gold Investing: A Gold IRA allows you to hold IRS-approved physical gold in a tax-advantaged retirement account, potentially improving after-tax returns compared to holding gold in taxable accounts.

Use Retirement Dollars for Gold (Without Upfront Tax Surprise)

If you’re exploring whether a rollover makes sense, Augusta’s free guide explains the basics and helps you understand what to look for before choosing a provider.

Request the Free Augusta Guide

Or call:

Conclusion: Finding Your Optimal Balance

The debate between gold vs stocks in retirement isn’t about choosing one over the other—it’s about finding the right balance that addresses both growth needs and risk management concerns. A thoughtfully constructed retirement portfolio that includes both assets can provide better risk-adjusted returns than either alone.

A well-balanced retirement portfolio can provide both financial security and peace of mind.

Stocks provide the growth engine that helps fund potentially decades of retirement and combat inflation, while gold offers stability, diversification, and protection against economic uncertainty. Together, they create a more resilient portfolio that can weather various economic conditions.

The optimal allocation between these assets will depend on your personal circumstances, risk tolerance, and retirement timeline. For most retirees, a modest gold allocation of 5-15% provides meaningful diversification benefits without significantly sacrificing long-term growth potential.

As you navigate retirement planning decisions, remember that the goal isn’t to perfectly time markets or predict which asset will perform best in any given year. Instead, focus on building a diversified portfolio that can perform reasonably well across different economic scenarios while limiting downside risk.

Ready to Add Gold to Your Retirement Strategy?

Learn how physical gold can enhance your retirement portfolio’s stability and protect against inflation with Augusta Precious Metals’ free guide. Discover tax-advantaged options like Gold IRAs and get expert guidance on the right allocation for your situation.

Or speak with a gold retirement specialist today: