Affiliate Disclosure

The owners of this website may be paid to recommend the following companies: Goldco, Augusta Precious Metals, Noble Gold Investments, and Birch Gold Group. The content on this website, including any positive reviews of the mentioned companies, and other reviews, may not be neutral or independent. We do believe in all the companies we recommend as being the most trustworthy in the business.

GoldenCrest Metals Company Overview

In this GoldenCrest Metals Review, we aim to shine a light on this precious metals rising star making waves in the industry. GoldenCrest Metals, founded in 2023, has quickly gained traction in the precious metals investment industry. Based in Calabasas, California, the company is committed to helping investors diversify their retirement portfolios with tangible assets like gold, silver, platinum, and palladium. GoldenCrest aims to set itself apart with transparency, ethical practices, and exceptional customer service.

<<<<<Get your FREE Precious Metals Guide and up to $25,000 in FREE Silver with Qualified Purchase!

Why Invest in Precious Metals?

Precious metals like gold and silver are often considered “safe-haven” assets, helping investors mitigate the impact of market volatility.

Precious Metals Are an Inflation Hedge

A Real-Life Comparison of Buying Power 1930 vs 2024: Gold vs the US Dollar

Gold and other metals are historically effective in protecting against inflation, as they retain intrinsic value.

The Designer Suit Example: Gold vs US Dollars

To give you an example, the cost of a designer suit, shoes, and tie would have been 1 ounce of gold, or about $20.67 in US dollars in the year 1930. You could get the same suit for an ounce of gold in 1980 but the cash price would cost you about $615.00. Now go to the current year 2024. The 1 ounce of gold could still buy you the designer suit, shoes and tie. But if you were to use US Dollars to make the same purchase it would cost you about $2700.00.

The 1 Ounce of Gold Preserved the Buying Power Over the Same Time Frame!

While the 1 ounce of gold has preserved the buying power to be able to buy the same suit and accessories in the 1930’s up to the present day, the US dollars have declined so much it would take 8,366% MORE dollars to match the 1 ounce of gold purchasing power. In Terms of over all buying power, the dollars have lost a significant 98.82% of their purchasing power between 1930 and 2024.

Other Reasons to Invest in Precious Metals

- Portfolio Diversification: Adding precious metals to an investment portfolio reduces dependence on traditional assets like stocks and bonds.

- Tangible Asset Benefits: Unlike stocks, precious metals are physical assets, providing investors with a unique sense of security.

By focusing on education and transparent transactions, GoldenCrest Metals aims to attract investors looking to leverage these benefits in their retirement portfolios.

Services and Offerings

GoldenCrest Metals offers a range of services tailored to different investment needs:

Gold IRAs

GoldenCrest specializes in Gold Individual Retirement Accounts (IRAs), allowing investors to include physical precious metals in their retirement plans. The company offers support through each step of the IRA process, including:

- Account Setup: GoldenCrest assists with account creation through a preferred custodian, streamlining the initial paperwork.

- Metal Selection: The company provides a curated selection of IRS-approved metals that meet eligibility for IRAs.

- Ongoing Management: GoldenCrest helps clients monitor and manage their portfolios, ensuring they remain aligned with investment goals.

Direct Precious Metals Purchases

For investors not interested in an IRA, GoldenCrest offers direct purchases of precious metals. These can be added to a personal portfolio or stored for security:

- Gold: American Gold Eagle, Canadian Gold Maple Leaf, and various gold bars.

- Silver: American Silver Eagle, Canadian Silver Maple Leaf, and silver bars.

- Platinum and Palladium: American Platinum Eagle and palladium bars.

Storage Options

GoldenCrest Metals partners with Delaware Depository, a highly secure and insured facility, to offer safe storage solutions. Investors have the following options:

- Non-Segregated Storage: Metals are stored alongside those of other investors, costing $100 annually.

- Segregated Storage: For increased security, this option stores metals separately, costing $150 annually.

The Delaware Depository employs Class 3 vaults and Lloyd’s of London-backed insurance coverage, giving investors peace of mind regarding the security of their assets.

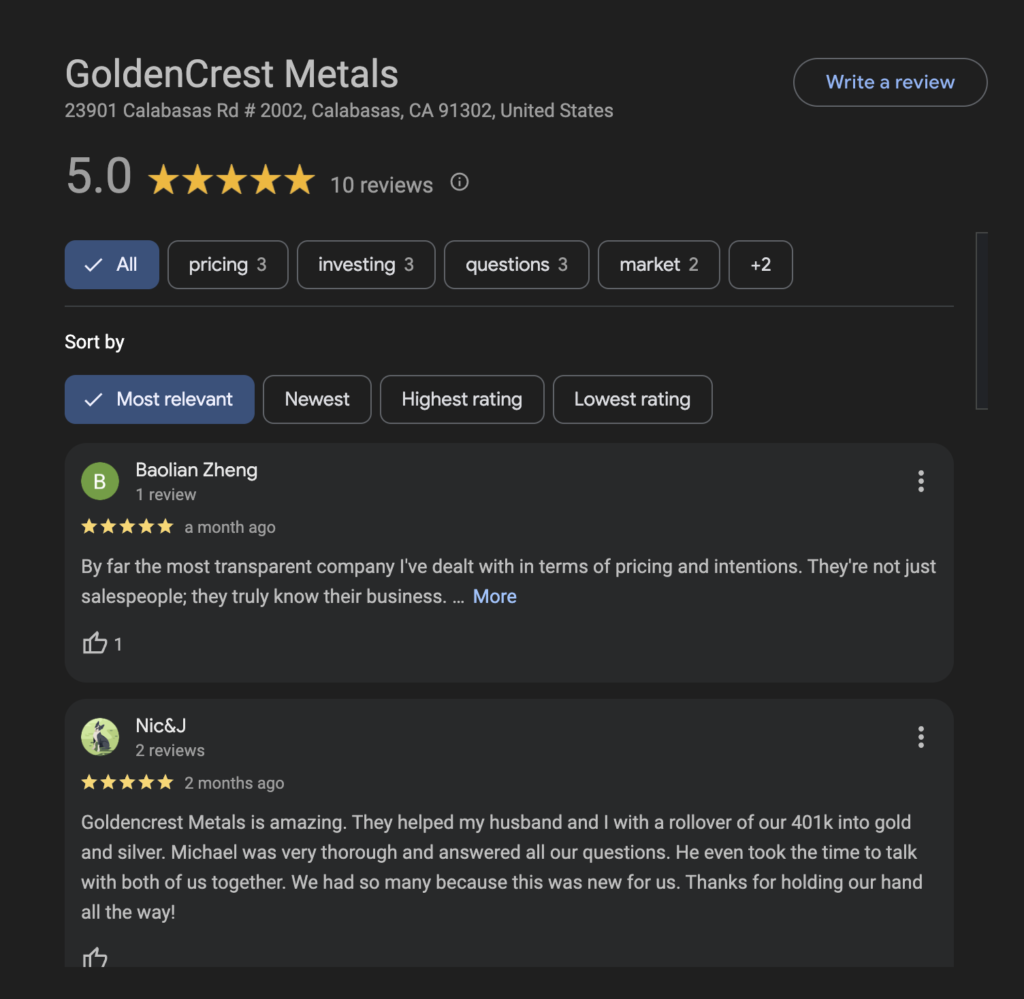

GoldenCrest Metals Customer Reviews and Reputation

GoldenCrest Metals has received positive reviews across various platforms:

- Better Business Bureau (BBB): The company holds an A- rating and has received strong customer feedback, indicating a commitment to service excellence.

- Trustpilot: GoldenCrest maintains a 4.0-star rating on Trustpilot, with customers praising the staff’s transparency and professionalism.

- Google Reviews: The company boasts a 5-star rating on Google, highlighting its dedication to customer satisfaction.

Customer feedback consistently emphasizes GoldenCrest’s knowledgeable staff, transparent pricing, and efficient processes. The company’s commitment to educating clients and providing tailored solutions has contributed to its positive reputation.

Fee Structure and Promotions

GoldenCrest Metals’ fee structure is designed to be straightforward and competitive:

- IRA Setup and Custodial Fees: GoldenCrest covers the setup fees for the first year. Afterward, the custodial fees are $100 per year through their preferred custodian, The Entrust Group.

- Storage Fees: Non-segregated storage costs $100 per year, while segregated storage is $150 per year.

GoldenCrest Metals Current Promotions

GoldenCrest Metals regularly offers promotional incentives to new customers, such as:

- First-Year Fee Waiver: GoldenCrest waives the first year’s custodial fees for all new IRA customers.

- Free Home Safe: Customers making direct purchases above $10,000 are eligible to receive a complimentary home safe.

- Up to $25,000 in Free Silver: Limited time offer with qualifying purchase.

Get a Free Gold Kit and Get up to $25,000 in FREE Silver for a limited time with Qualifying Purchase!

Educational Resources and Support

GoldenCrest Metals is committed to educating its clients about precious metals investments. They offer:

- Educational Articles: Topics include investment strategies, economic analysis, and the benefits of precious metals.

- Video Resources: Industry expert Bob Iaccino provides insights through informative videos, helping investors understand market dynamics and make well-informed decisions.

- One-on-One Consultations: GoldenCrest offers personalized consultations to help investors develop tailored strategies that align with their financial goals.

These resources are designed to empower investors, ensuring they feel confident in their decisions.

Market Insights and Analysis

GoldenCrest offers insights into the global market trends that can impact precious metals prices. By providing real-time updates, investors can stay informed about:

- Gold Price Trends: Understanding the factors driving gold prices, such as inflation, geopolitical events, and currency fluctuations.

- Silver’s Industrial Demand: Silver’s uses in technology, solar panels, and other industries significantly impact its price.

- Global Economic Factors: From interest rates to supply chain issues, GoldenCrest’s insights offer an understanding of how broader economic trends can affect precious metals.

This market analysis aims to provide clients with a comprehensive view of potential investment outcomes.

Security and Insurance

GoldenCrest Metals takes security seriously, ensuring that clients’ investments are protected through:

- Partnership with Delaware Depository: All assets are stored in Class 3 vaults and secured by insurance underwritten by Lloyd’s of London.

- Insurance Coverage: Clients’ assets are fully insured during storage, ensuring peace of mind regarding the safety of their precious metals.

- Secure Shipping: For customers opting for home storage, GoldenCrest uses secure shipping methods and offers tracking options to guarantee a safe delivery.

These measures reflect GoldenCrest’s commitment to maintaining the highest standards of security for its clients’ investments.

Pros and Cons of Choosing GoldenCrest Metals

Pros

- Transparent Fee Structure: GoldenCrest offers competitive and clear fees, with promotions for new customers.

- Educational Focus: The company’s extensive educational resources and personalized support help clients make informed decisions.

- Positive Reputation: Strong customer reviews across various platforms speak to the company’s reliability.

- Security Measures: Through Delaware Depository, clients’ investments are securely stored and fully insured.

Cons

- Limited History: As a relatively new company, GoldenCrest lacks a long track record in the industry, but has received nothing but stellar reviews during it’s short time in business.

- Geographic Limitation: Currently, GoldenCrest serves primarily U.S.-based investors, limiting access for international clients.

Comparison with Competitors

To assess GoldenCrest’s positioning, it’s essential to compare the company with other key players in the industry:

- Augusta Precious Metals: Known for its strong customer service, Augusta also specializes in Gold IRAs, though it requires a higher minimum investment ($50,000) than GoldenCrest.

- Birch Gold Group: This company offers a wide selection of precious metals and has a strong reputation. However, its fee structure may be slightly higher than GoldenCrest’s.

- Noble Gold Investments: Noble Gold offers physical metals and precious metals IRAs, but does not offer premium bullion or collectible metals.

GoldenCrest stands out for its competitive pricing and customer education, making it a solid choice for those seeking an entry-level option in the precious metals market.

Steps to Open a Gold IRA with GoldenCrest Metals

Opening a Gold IRA with GoldenCrest involves several straightforward steps:

- Initial Consultation: Speak with a GoldenCrest representative to discuss investment goals and account setup. Start by filling out a request here for a free kit.

- Account Creation: GoldenCrest assists in creating a self-directed IRA through a trusted custodian.

- Fund Transfer: Transfer funds from an existing retirement account or contribute directly to the new IRA.

- Metal Selection: Work with GoldenCrest to choose IRS-approved metals that align with your investment strategy.

- Secure Storage: Once purchased, metals are securely stored in a preferred depository.

The company’s representatives assist clients throughout each stage, ensuring a seamless experience.

Get a Free Precious Metals Kit Now!

Frequently Asked Questions

GoldenCrest focuses on transparency, customer education, and competitive pricing. It is committed to providing clients with the resources and guidance needed to make informed investment decisions.

Yes, GoldenCrest Metals allows investors to include other IRS-approved metals such as silver, platinum, and palladium in their IRAs, adding flexibility to the investment portfolio.

GoldenCrest Metals partners with Delaware Depository, providing Class 3 vaults and insurance through Lloyd’s of London to ensure the safety and security of clients’ assets.

Conclusion

GoldenCrest Metals, although new, has established itself as a promising option for investors interested in precious metals IRAs and direct purchases. Its dedication to transparency, educational resources, and customer service make it a reliable choice in the industry. With a straightforward fee structure and secure storage options, GoldenCrest caters to both novice and experienced investors looking to diversify their retirement portfolios with precious metals.