In an era of economic uncertainty, inflation concerns, and market volatility, investors are increasingly looking beyond traditional assets for retirement security. A Silver IRA—an Individual Retirement Account that holds physical silver instead of paper assets—has emerged as a compelling option for those seeking to diversify their retirement portfolios. But is adding physical silver to your retirement strategy the right move? This comprehensive guide explores the potential benefits, important considerations, and practical steps to help you make an informed decision about whether a Silver IRA belongs in your financial future.

What Is a Silver IRA?

A Silver IRA is a self-directed Individual Retirement Account that allows you to hold physical silver bullion and coins as part of your retirement savings. Unlike conventional IRAs that typically invest in stocks, bonds, and mutual funds, a Silver IRA gives you the ability to own tangible precious metals within a tax-advantaged retirement account.

These specialized accounts follow the same basic tax rules as traditional or Roth IRAs but require a custodian that specializes in precious metals. The physical silver is stored in an IRS-approved depository—not in your home—and all purchases must meet specific purity standards set by the IRS.

Understand Your Silver IRA Options

Not sure if a Silver IRA is right for your retirement strategy? Get a free guide and talk with specialists who can explain how precious metals IRAs work, what fees to expect, and what questions to ask before opening an account.

The Case for a Silver IRA: Potential Benefits

Adding physical silver to your retirement portfolio through a Silver IRA offers several potential advantages worth considering. Here’s why many investors are allocating a portion of their retirement savings to this precious metal:

Hedge Against Inflation

Throughout history, silver has maintained its purchasing power during periods of inflation when paper currencies lose value. When the cost of living rises, precious metals like silver often appreciate in response, potentially preserving your retirement savings’ buying power.

Portfolio Diversification

Silver typically moves independently of stocks and bonds, sometimes even in the opposite direction. This negative correlation can help reduce overall portfolio volatility and risk. During market downturns when traditional assets struggle, silver may provide a counterbalance to portfolio losses.

Tangible Asset Ownership

Unlike stocks or bonds that exist primarily as electronic entries, physical silver represents a tangible asset you actually own. This provides a sense of security for many investors, knowing their retirement savings include real, physical wealth that can’t be erased by a computer glitch or corporate bankruptcy.

Industrial Demand Growth

Beyond its monetary value, silver has extensive industrial applications in electronics, solar panels, medical devices, and more. As technology advances, industrial demand for silver continues to grow, potentially supporting long-term price appreciation that could benefit your retirement savings.

“Silver offers a unique combination of inflation protection, portfolio diversification, and industrial demand that makes it worth considering as part of a comprehensive retirement strategy.”

Get a Silver IRA Starter Checklist

Want a step-by-step explanation of how a precious metals IRA works (custodian, funding, storage, and fees)? Download the free guide and review your options with a specialist.

Important Considerations and Potential Drawbacks

While a Silver IRA offers compelling benefits, it’s equally important to understand the challenges and limitations before committing your retirement funds. Consider these factors carefully:

Advantages

- Potential hedge against inflation

- Portfolio diversification beyond paper assets

- Ownership of tangible, physical assets

- Protection against currency devaluation

- Growing industrial demand supports value

Challenges

- Higher fees than traditional IRAs

- Required third-party storage

- Potentially lower liquidity

- Price volatility concerns

- No income generation (dividends/interest)

Storage and Custodial Requirements

The IRS mandates that physical silver in an IRA must be stored in an approved depository—you cannot take personal possession without triggering taxes and penalties. This means paying ongoing storage and insurance fees, typically ranging from $100-$300 annually, depending on your holdings.

Fee Structure

Silver IRAs generally involve higher fees than traditional retirement accounts. Beyond standard IRA fees, you’ll typically encounter:

| Fee Type | Typical Cost | Frequency | Notes |

| Account Setup | $50-$150 | One-time | Higher for larger accounts |

| Annual Maintenance | $75-$300 | Annual | May scale with account size |

| Storage & Insurance | $100-$300 | Annual | Based on holdings value |

| Transaction Fees | $40-$50 | Per transaction | For buying/selling metals |

Liquidity Considerations

While physical silver is generally liquid, converting it to cash within an IRA may take longer than selling stocks or bonds. The process involves instructing your custodian to sell the metals, which can take several days to complete. Additionally, you may face dealer buyback fees or less favorable pricing when selling.

IRS-Approved Silver Products

Not all silver products qualify for IRA investment. The IRS requires silver to be at least 99.9% pure and in the form of bars or coins produced by an approved refiner or government mint. Common IRA-eligible silver products include:

- American Silver Eagle coins

- Canadian Silver Maple Leaf coins

- Austrian Silver Philharmonic coins

- Silver bars and rounds from approved refiners (minimum 99.9% purity)

Compare Top Silver IRA Companies

If you’re interviewing providers, start with a written fee schedule and a checklist of the questions that expose markups, storage options, and ongoing costs. Download the free comparison guide and speak with a specialist if you’d like help evaluating your options.

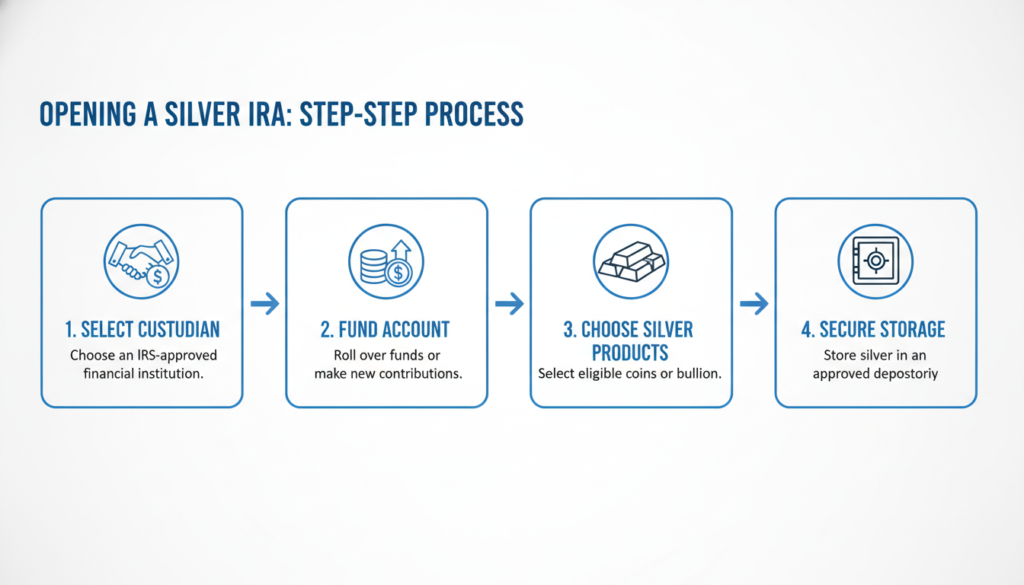

How to Get Started with a Silver IRA

If you’ve decided that a Silver IRA aligns with your retirement strategy, here’s a step-by-step guide to establishing your account:

-

Choose a Reputable Custodian

Select a self-directed IRA custodian that specializes in precious metals. Look for companies with strong reputations, transparent fee structures, and excellent customer service. Research customer reviews, years in business, and industry credentials before making your decision.

-

Open and Fund Your Account

Complete the necessary paperwork to establish your self-directed IRA. You can fund your new account through:

- Direct contribution: Subject to annual IRA contribution limits ($7,000 for 2026 if under 50; $8,000 if 50 or older)

- Transfer from existing IRA: Moving funds from another IRA without taking possession

- 401(k) rollover: Rolling over funds from a previous employer’s retirement plan

-

Select Your Silver Products

Work with your custodian to purchase IRS-approved silver products. Focus on recognized, liquid options with reasonable premiums over the spot price of silver. Your custodian will help ensure all purchases meet IRS requirements for purity and authenticity.

-

Arrange Secure Storage

Your silver will be shipped directly to an IRS-approved depository for secure storage. Your custodian will typically have partnerships with several storage facilities, giving you options for location and segregated vs. non-segregated storage.

Important Reminder

When establishing a Silver IRA, be wary of high-pressure sales tactics or companies advertising “free silver” promotions. Reputable precious metals IRA companies focus on education and transparency rather than aggressive sales techniques.

Get the Step-by-Step Guide (Custodian, Funding, Storage)

If you want a clear walkthrough of the Silver IRA process and the common costs involved, download the free guide and review your questions with a specialist.

Alternatives to Physical Silver in an IRA

If you’re interested in silver exposure but concerned about the requirements of a physical Silver IRA, consider these alternatives:

Silver ETFs

Silver Exchange-Traded Funds (ETFs) offer exposure to silver prices without physical storage concerns. These can be held in traditional IRAs with lower fees, though you don’t own actual silver.

Mining Stocks

Investing in silver mining companies provides indirect exposure to silver with potential dividend income. These stocks can be more volatile than physical silver but offer growth potential beyond metal price movements.

Diversified Precious Metals IRA

Instead of focusing solely on silver, consider a precious metals IRA that includes gold, platinum, and palladium alongside silver for broader diversification within the metals sector.

| Investment Option | Pros | Cons | Best For |

| Physical Silver IRA | Direct ownership, inflation hedge, tangible asset | Higher fees, storage requirements, less liquid | Long-term investors seeking tangible assets |

| Silver ETFs | Lower fees, high liquidity, easy trading | No physical ownership, counterparty risk | Investors wanting simple silver exposure |

| Mining Stocks | Growth potential, possible dividends | Company-specific risks, higher volatility | Growth-oriented investors comfortable with stocks |

| Diversified Metals IRA | Broader diversification, balanced exposure | Similar fees to Silver IRA, complexity | Investors seeking comprehensive metals exposure |

Explore All Your Silver Investment Options

If you’re weighing physical metals vs. ETFs or mining stocks, a quick strategy conversation can help you identify tradeoffs (fees, liquidity, and how each option behaves in volatility). Download the guide to start, then call if you want help thinking it through.

Is a Silver IRA Right for You?

A Silver IRA isn’t suitable for everyone. Consider your personal circumstances, investment goals, and risk tolerance when deciding if physical silver belongs in your retirement portfolio.

A Silver IRA May Be Right For You If:

- You’re concerned about inflation and currency devaluation

- You want to diversify beyond traditional paper assets

- You have a long-term investment horizon (10+ years)

- You already have a solid foundation in traditional retirement accounts

- You’re comfortable with the additional fees and storage requirements

Consider Other Options If:

- You need regular income from your investments

- You prefer maximum liquidity and minimal fees

- You’re just starting to build your retirement savings

- You’re close to retirement age and need stable, predictable returns

- You’re uncomfortable with price volatility

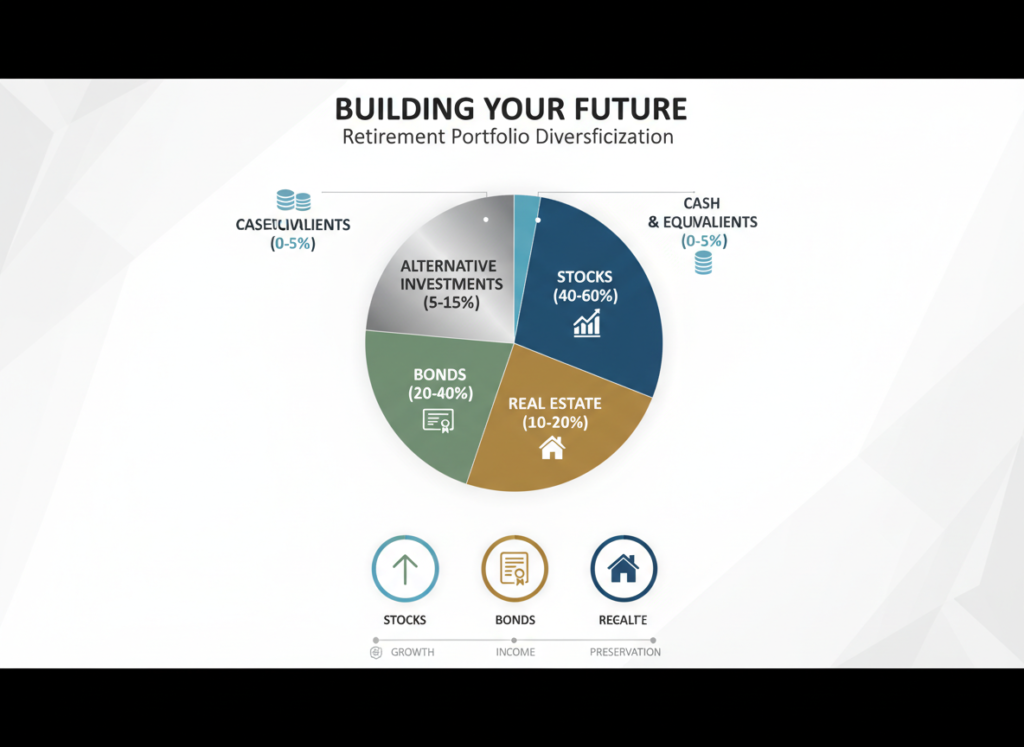

“The ideal allocation to precious metals, including silver, is typically between 5-15% of your total portfolio, depending on your risk tolerance and investment timeline.”

Expert Recommendations and Best Practices

Financial advisors and precious metals experts offer these recommendations for those considering a Silver IRA:

Allocation Strategy

Most financial advisors recommend limiting precious metals exposure to 5-15% of your total retirement portfolio. This provides diversification benefits without overexposure to a single asset class. Consider silver as part of a broader precious metals strategy that may include gold and other metals.

Dollar-Cost Averaging

Rather than making a single large purchase, consider building your silver position gradually through regular purchases over time. This strategy helps mitigate the impact of silver’s price volatility and potentially improves your average purchase price.

Due Diligence

Research potential custodians and silver dealers thoroughly. Check for Better Business Bureau ratings, customer reviews, and regulatory compliance. Be particularly wary of companies with aggressive sales tactics or promises of extraordinary returns.

Regular Portfolio Review

As with any investment, regularly review your Silver IRA’s performance and adjust your strategy as needed. Market conditions change, and your allocation to silver may need to be rebalanced periodically to maintain your desired portfolio balance.

Tax Considerations

A Silver IRA follows the same tax rules as traditional or Roth IRAs. With a traditional Silver IRA, contributions may be tax-deductible, and growth is tax-deferred until withdrawal. With a Roth Silver IRA, contributions are made with after-tax dollars, but qualified withdrawals are tax-free. Consult with a tax professional to determine which structure best suits your situation.

Get a Free Metals IRA Planning Guide

If you’re deciding between Traditional vs. Roth structures and want to understand how metals IRAs fit into a broader retirement plan, download the free guide and review your questions with a specialist.

Conclusion: Making Your Decision

A Silver IRA can be a valuable component of a well-diversified retirement strategy, particularly for investors concerned about inflation, currency devaluation, and market volatility. The tangible nature of physical silver provides a sense of security that paper assets cannot match, while its industrial applications offer growth potential beyond its monetary value.

However, the higher fees, storage requirements, and potential liquidity challenges mean a Silver IRA isn’t suitable for everyone. The ideal approach is to view silver as one piece of a comprehensive retirement strategy rather than a standalone solution.

Before making any decision about a Silver IRA, consult with qualified financial and tax professionals who can provide personalized advice based on your specific circumstances, goals, and risk tolerance. They can help you determine the appropriate allocation to silver and integrate it effectively into your overall retirement plan.

Ready to Explore Silver IRA Options?

Take the next step toward a more diversified retirement portfolio with trusted guidance. Download the free guide and speak with a specialist if you want help evaluating custodians, fees, and storage choices.

Request Your Free Silver IRA Guide

Or speak with a specialist:

Frequently Asked Questions About Silver IRAs

Can I store my Silver IRA metals at home?

No. IRS regulations require that precious metals in an IRA must be stored in an approved depository. Taking personal possession of the metals would be considered a distribution, potentially triggering taxes and penalties.

What’s the minimum investment needed to start a Silver IRA?

Minimum requirements vary by custodian, typically ranging from $5,000 to $10,000 for new accounts. Some companies may offer lower minimums or waive certain fees for larger investments.

Can I roll over my existing 401(k) or IRA into a Silver IRA?

Yes. Most qualified retirement plans, including 401(k)s, 403(b)s, and traditional IRAs, can be rolled over into a self-directed IRA that holds physical silver. This process can typically be completed without tax penalties if done correctly.